Overview

Net 30 payment terms offer contractors a compassionate approach, allowing clients a 30-day period to settle their invoices after the billing date. This flexibility not only supports effective cash flow management but also nurtures valuable client relationships.

However, it’s essential to recognize the challenges that can arise from this arrangement. While it can enhance customer loyalty, contractors may experience emotional and operational stress due to potential cash flow issues stemming from delayed payments.

This delicate balance between offering flexibility and maintaining financial stability is crucial. By acknowledging these challenges, contractors can find a path forward that fosters both client satisfaction and their own financial health.

Introduction

In the ever-changing world of contracting, managing cash flow effectively is not just a necessity—it’s vital for sustaining operations and nurturing client relationships. Many contractors find themselves navigating the complexities of net 30 payment terms, which have become a common invoicing strategy. While these terms offer clients a full month to settle their accounts, they also provide contractors with the flexibility to manage their finances. This delicate balance fosters trust and helps contractors maneuver through the unpredictable nature of project timelines and client payments.

Yet, despite the potential for enhanced customer loyalty that net 30 terms can bring, they also introduce challenges, particularly when it comes to cash flow stability. As the construction industry continues to evolve, it’s crucial for contractors to comprehend the implications of these payment terms and consider exploring alternatives. This understanding is essential for those who aspire to thrive in a competitive market, ensuring they can maintain both their operations and their valued client relationships.

Define Net 30 Payment Terms

To understand what net 30 payment terms mean, it refers to a common invoicing arrangement that allows customers a 30-day grace period from the invoice date to settle the total amount owed. This practice is particularly prevalent in industries such as construction and home services, serving as a vital tool for effective cash flow management. By issuing an invoice with , builders extend credit to their clients, granting them a month to settle their accounts without incurring interest or penalties. This arrangement is especially beneficial for builders who face cash flow challenges while awaiting client reimbursements, enabling them to maintain operational stability and invest in ongoing projects.

Field Complete’s comprehensive field service management software simplifies this process, empowering professionals to schedule, estimate, and collect payments with ease. With automated billing solutions and secure document storage, contractors can efficiently manage their invoicing procedures under Net 30 conditions. This user-friendly system ensures that even those with minimal experience can navigate it effectively, aligning invoicing practices with financial needs.

As Armando Armendariz, Partner & Director at Viva Capital, insightfully notes, “Ultimately, whether to provide net 30 or another arrangement relies on your business’s operational requirements and the financial reliability of your clients.” This underscores the importance of evaluating your specific circumstances when determining transaction conditions.

Moreover, contractors should remain vigilant regarding the potential challenges associated with delayed payments. A case study titled “” reveals that if a client consistently pays after the due date, businesses should reconsider their invoicing terms and contemplate implementing late fees or adjusting future contracts to mitigate risk. Open communication with clients can lead to mutually beneficial solutions and improved financial practices.

In the construction sector, research indicates that a significant number of builders utilize Net 30 arrangements, highlighting their prevalence and importance in maintaining operational stability. By understanding what net 30 payment terms mean and effectively implementing these terms, along with leveraging Field Complete’s automated invoicing solutions, contractors can navigate cash flow challenges more effectively and ensure the sustainability of their projects.

Contextualize Net 30 in Payment Terms

In the business world, many people ask [what does net 30 payment terms mean](https://constructioncostaccounting.com/post/impact-delayed-payments-on-revenue), as it is a widely recognized term often seen alongside net 15, net 60, and net 90. These terms clarify what does net 30 payment terms mean by defining the timeframe in which payment is expected following the issuance of an invoice. For builders, what does net 30 payment terms mean is particularly favored as it strikes a balance between client flexibility and the necessity for consistent cash flow. In industries like HVAC and plumbing, where project timelines can vary significantly, net 30 terms empower professionals to manage their finances effectively while fostering trust with their clients.

Field Complete plays a vital role in this process by offering streamlined invoicing solutions that allow professionals to create polished invoices quickly, whether they’re in the office or on-site. With features such as , invoice scheduling, and the ability to convert estimates into invoices, professionals can save precious time and receive payments more promptly. This efficiency is crucial for maintaining cash flow, particularly when understanding what does net 30 payment terms mean.

Data indicates that builders who understand what does net 30 payment terms mean can better manage their cash flow compared to those who opt for shorter (net 15) or longer (net 60) terms. Research shows that builders often inquire about what does net 30 payment terms mean, as they experience a 20% increase in cash flow stability, which is especially important in the construction industry, where timely payments can significantly affect project execution and supplier relationships.

Expert insights underscore the necessity of clear invoicing in this context. As , who specializes in financial management solutions, points out, “Invoices play a crucial role in this process, acting as friendly reminders about the who, what, and when of transactions.” This emphasizes the importance for builders to maintain systematic billing practices, ensuring that clients are gently reminded of their responsibilities. Field Complete’s invoicing features support this by enabling invoice scheduling and allowing workers to accept prepayments, further bolstering their cash flow needs.

Moreover, case studies reveal the tangible effects of financial terms. For instance, a general builder awaiting $150,000 for a government project effectively utilized invoice factoring to address cash flow shortages, securing 90% of the invoice total in advance. This approach not only highlights the effectiveness of net 30 terms, or what does net 30 payment terms mean, in facilitating timely transactions but also demonstrates how these conditions enable builders to meet their financial obligations without delay.

In summary, knowing what does net 30 payment terms mean is essential for builders, particularly in the HVAC sector, as they promote financial stability and nurture positive relationships between clients and builders. By leveraging Field Complete’s comprehensive field service management software, professionals can simplify their invoicing and collection processes, ensuring they remain on top of their financial commitments.

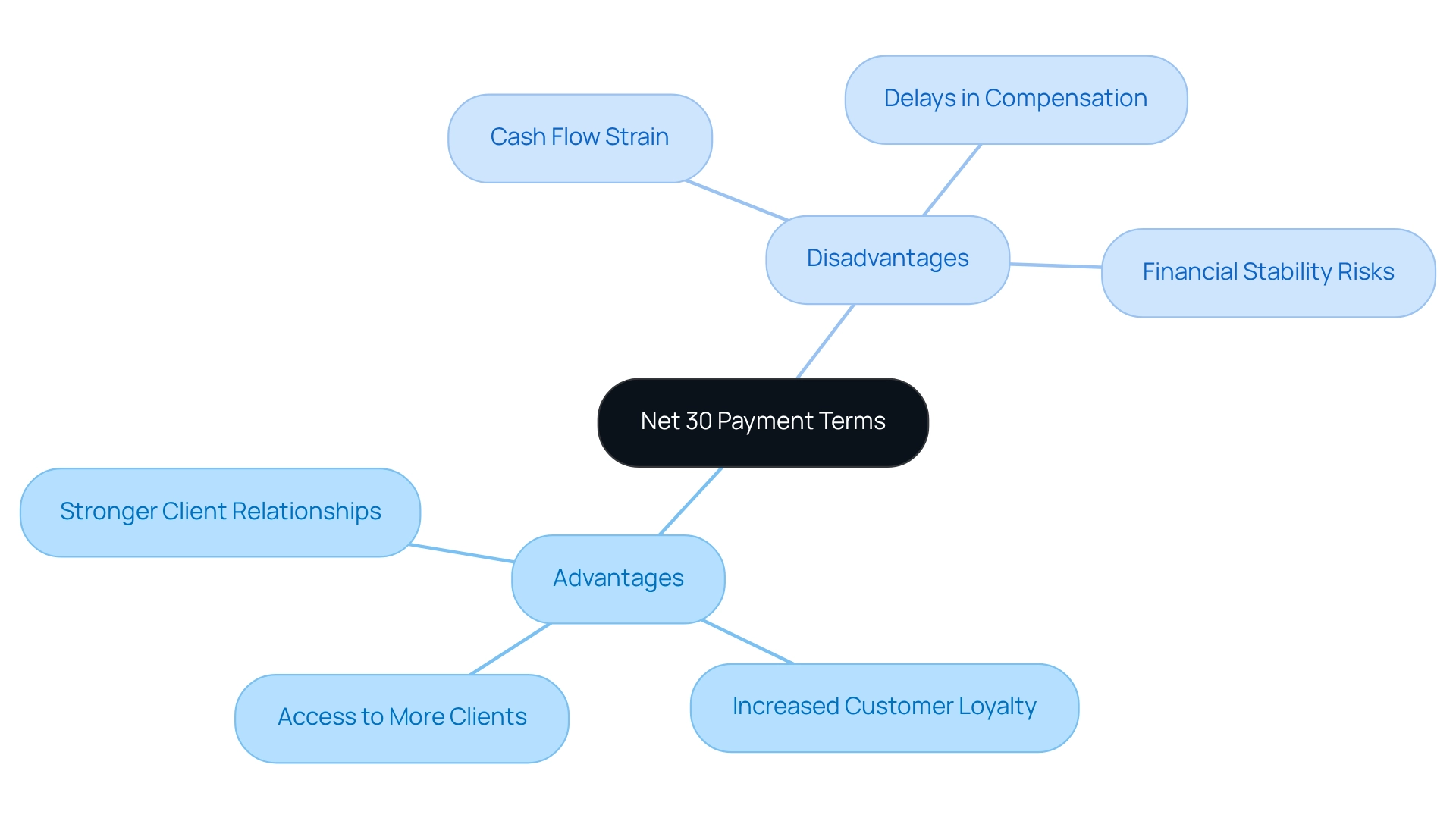

Evaluate Advantages and Disadvantages of Net 30

Builders often wonder [what does net 30 payment terms mean](https://agencyanalytics.com/blog/why-net-30-is-bad), as these conditions can bring significant benefits, particularly in fostering stronger client relationships. By granting clients a 30-day window to settle invoices, service providers demonstrate trust and flexibility, illustrating what does net 30 payment terms mean, which can lead to increased customer loyalty and positive referrals. This approach can also open doors to a wider array of clients, especially those grappling with cash flow challenges at the time of service.

However, it’s important to recognize that understanding what does net 30 payment terms mean comes with its own set of challenges. The core issue revolves around cash flow management; waiting for payments can create financial strain, particularly when builders have ongoing expenses such as salaries and materials. Many builders report experiencing , leading to questions about what does net 30 payment terms mean, which further complicates their cash flow situations.

As a result, it becomes crucial for builders to carefully evaluate the balance between the benefits of nurturing client relationships and the potential risks to their financial stability when considering what does net 30 payment terms mean. Expert insights suggest that while these practices can enhance client confidence, they necessitate robust cash flow strategies to mitigate the risks associated with delayed payments. By embracing these strategies, builders can navigate the complexities of client relationships while safeguarding their financial health.

Explore Alternatives to Net 30 Payment Terms

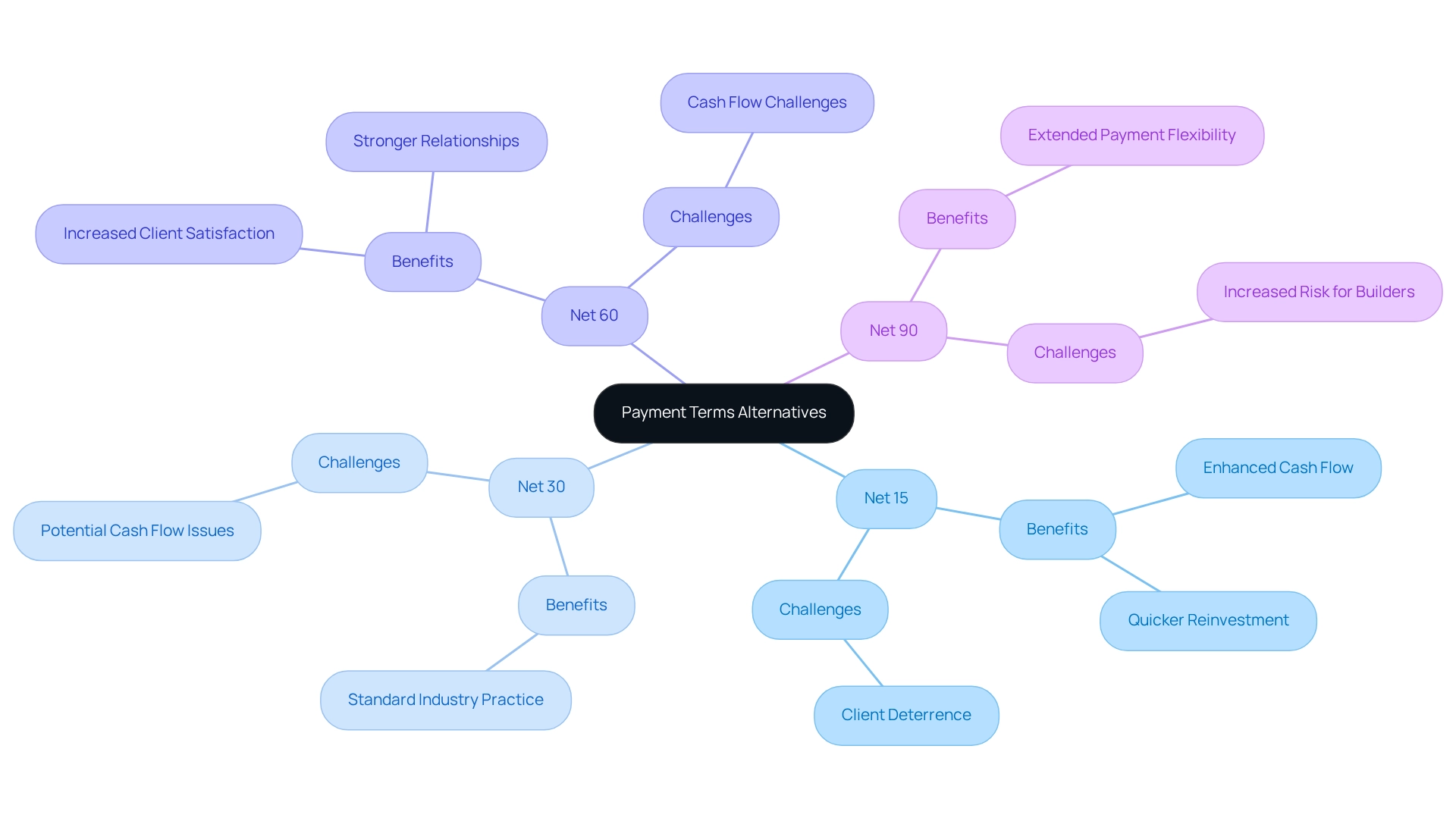

Exploring options beyond what does net mean, including net 15, net 60, and net 90, reveals a spectrum of benefits and challenges for builders. Net 15 terms, requiring payment within 15 days, can significantly enhance cash flow, allowing contractors to reinvest in their operations more swiftly. However, this shorter timeframe might deter clients who prefer longer payment durations. Conversely, net 60 or net 90 arrangements offer clients additional time to settle invoices, which can lead to increased customer satisfaction and the cultivation of enduring relationships. Yet, these extended terms may pose cash flow challenges for builders, highlighting the need to balance client expectations with financial health. Some builders find that advance compensation or partial payments at contract signing effectively mitigate the risks associated with delayed payments. This strategy not only secures immediate cash flow but also fosters a commitment from the client. Ultimately, selecting the right financial terms should resonate with the builder’s financial strategy and relationship management goals.

Current trends in the HVAC industry indicate a growing preference for net 15 arrangements among builders, as they seek to maintain liquidity in a competitive landscape. Real-life examples illustrate that builders who adopt varied compensation terms often experience improved financial compliance and stronger client relationships. For instance, effective communication of financial terms has been shown to build trust and understanding, leading to timely transactions and enhanced professional connections. As contractors navigate these options, expert insights emphasize that aligning payment terms with business objectives is vital for sustainable growth.

Conclusion

The exploration of net 30 payment terms reveals their dual nature as both a valuable tool for contractors and a potential source of cash flow challenges. While these terms allow clients a full 30 days to settle invoices, fostering trust and flexibility, they can also lead to financial strain for contractors who are waiting for payment amidst ongoing operational costs. It’s understandable that this situation can create stress, as the pressure of managing cash flow is a common struggle in the industry.

Alternatives to net 30, such as net 15 or extended terms like net 60 and net 90, present different advantages and challenges. Shorter terms can improve cash flow but may deter some clients, while longer terms might enhance customer satisfaction at the cost of financial stability. It’s crucial for contractors to navigate these choices thoughtfully, considering their operational needs and client preferences, as well as their overall financial strategy.

Ultimately, understanding and effectively managing payment terms is essential for contractors aiming to thrive in a competitive landscape. By leveraging technology, such as Field Complete’s field service management software, contractors can streamline their invoicing processes and improve cash flow stability. This proactive approach not only ensures financial health but also strengthens the foundation of trust and reliability that is vital for enduring client relationships. In navigating the complexities of payment terms, contractors can position themselves for success, balancing client satisfaction with their own financial stability. Remember, you are not alone in this journey; there are tools and resources available to help you manage these challenges with confidence.

Frequently Asked Questions

What do net 30 payment terms mean?

Net 30 payment terms refer to an invoicing arrangement that allows customers a 30-day grace period from the invoice date to settle the total amount owed without incurring interest or penalties.

In which industries are net 30 terms commonly used?

Net 30 terms are particularly prevalent in industries such as construction and home services.

How do net 30 terms benefit builders?

Builders can extend credit to clients, allowing them a month to pay, which helps manage cash flow challenges while waiting for client reimbursements, thus maintaining operational stability and enabling investment in ongoing projects.

How can Field Complete’s software assist with net 30 payment terms?

Field Complete’s software simplifies invoicing under net 30 conditions by providing automated billing solutions and secure document storage, making it easier for contractors to manage scheduling, estimating, and payment collection.

What should businesses consider when providing net 30 terms?

Businesses should evaluate their operational requirements and the financial reliability of their clients to determine whether to offer net 30 or other payment arrangements.

What challenges might contractors face with net 30 payment terms?

Contractors may face challenges with delayed payments, which can impact cash flow and operational stability.

What steps should be taken if a client consistently pays late?

Businesses should reconsider their invoicing terms, possibly implementing late fees or adjusting future contracts, while maintaining open communication with clients to find mutually beneficial solutions.

Why are net 30 arrangements important in the construction sector?

Research indicates that a significant number of builders utilize net 30 arrangements, highlighting their importance in maintaining operational stability and effectively navigating cash flow challenges.

List of Sources

- Define Net 30 Payment Terms

- US Construction By the Numbers: 100+ Construction Statistics You Need to Know in 2023 (https://levelset.com/blog/us-construction-statistics-you-need-to-know)

- Net 30 Payment Terms: What They Are & Why it Matters (https://vivacf.net/insights/understanding-net-30-payment-terms)

- 1stcommercialcredit.com (https://1stcommercialcredit.com/blog/net-30-payment-terms)

- sage.com (https://sage.com/en-us/blog/net-30-payment-terms)

- Contextualize Net 30 in Payment Terms

- ACH Fees: How Much does ACH Payment Processing Cost? | Tipalti (https://tipalti.com/resources/learn/ach-fees)

- invoicera.com (https://invoicera.com/blog/financial-management/net-30)

- The Impact of Delayed Payments on Construction Revenue (https://constructioncostaccounting.com/post/impact-delayed-payments-on-revenue)

- Evaluate Advantages and Disadvantages of Net 30

- Net 30 Terms: Good Or Bad For Your Business? | Planergy Software (https://planergy.com/blog/net-30-terms)

- What Does Net 30 Mean? A Complete Breakdown of Payment Terms – Field Complete (https://fieldcomplete.com/blog/financial-management-for-contractors/what-does-net-30-mean-a-complete-breakdown-of-payment-terms)

- Why Net 30 Is Bad – AgencyAnalytics (https://agencyanalytics.com/blog/why-net-30-is-bad)

- Explore Alternatives to Net 30 Payment Terms

- EFT Meaning: What is an Electronic Funds Transfer? (https://tipalti.com/resources/learn/eft-meaning)

- fhwa.dot.gov (https://fhwa.dot.gov/ipd/value_capture/case_studies/hays_county_texas_transportation_reinvestment_zones.aspx)

- 1stcommercialcredit.com (https://1stcommercialcredit.com/blog/net-30-payment-terms)

- buildern.com (https://buildern.com/resources/blog/contractor-payment-terms)