Overview

Plumbing business insurance is not just a necessity; it is a vital lifeline for contractors navigating the complexities of their work. The challenges they face—accidents, property damage, and employee injuries—can be overwhelming. These risks can lead to significant financial strain and emotional distress, impacting not only their business but also their peace of mind. By securing the right insurance, contractors can protect themselves against these unforeseen events, alleviating some of the burdens they carry.

This insurance does more than just mitigate financial risks; it also ensures compliance with legal requirements, which can be daunting for many. Moreover, it enhances a company’s reputation, making it more appealing to clients who prioritize professionalism and responsibility. When clients see that a contractor is insured, it instills a sense of trust and confidence, fostering stronger relationships and ultimately leading to more business opportunities.

In essence, plumbing business insurance serves as a protective shield, allowing contractors to focus on their craft without the constant worry of what could go wrong. It is a crucial step towards building a sustainable and reputable business, one that not only survives but thrives in today’s competitive landscape.

Introduction

In the ever-changing world of plumbing, where surprises can arise at any moment, protecting your business with the right insurance coverage is not merely a wise choice—it’s a necessity. Plumbing business insurance serves as a vital safety net, shielding contractors from numerous risks such as:

- Accidents

- Property damage

- Employee injuries

As the industry grapples with increasing costs and new challenges, grasping the significance of different insurance types—from general liability to workers’ compensation—becomes crucial. This article explores the essential elements of plumbing business insurance, providing insights into the necessary coverage options, factors that influence costs, and strategies for selecting the right policies. By equipping contractors with this understanding, we empower them to navigate the complexities of insurance, ensuring their operations remain resilient and secure in a competitive landscape.

The Importance of Plumbing Business Insurance

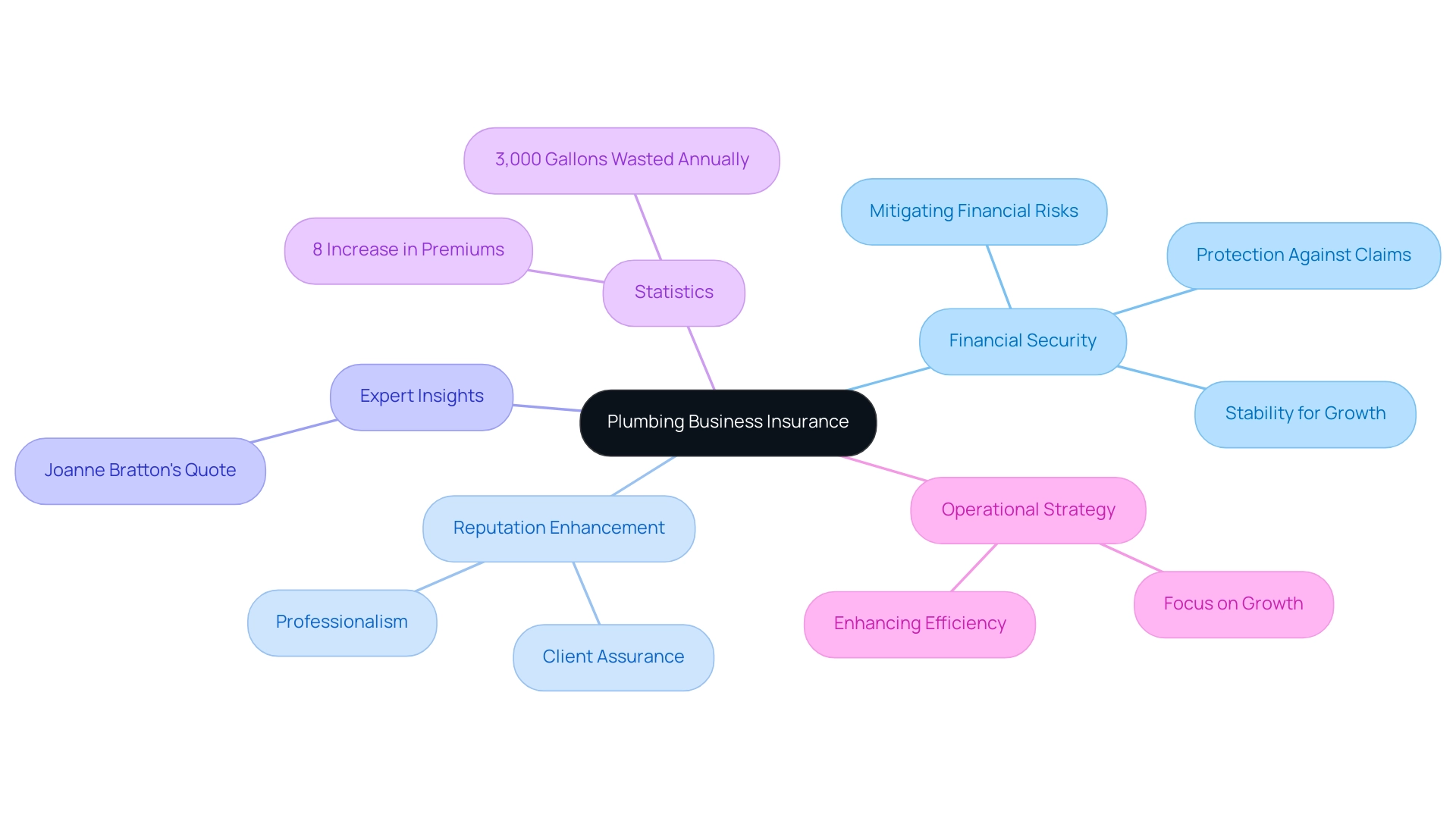

Plumbing business insurance is vital for contractors, offering essential protection against the various hazards encountered in daily operations. It provides crucial financial security against claims stemming from accidents, property damage, and injuries that may occur on the job. As we look ahead to 2025, the financial repercussions of pipe failures remain significant; statistics reveal that a single incident can incur substantial costs, potentially jeopardizing a business without adequate protection.

The necessity of trade coverage, particularly plumbing business insurance, is underscored by expert insights, which highlight that such protection not only mitigates financial risks but also enhances a company’s reputation. Clients are increasingly inclined to engage contractors who carry plumbing business insurance, as this assurance reflects a commitment to professionalism and responsibility. Furthermore, commercial auto coverage premiums have seen a notable rise, with an 8% increase recorded in 2021, illustrating the growing expenses associated with operating a plumbing enterprise.

Joanne Bratton poignantly emphasizes the importance of safeguarding corporate assets, stating, “Property coverage safeguards your property investment, including office space and any tools or equipment stored on the company’s owned or leased premises.” This statement reinforces the necessity for comprehensive protection for contractors.

Beyond shielding against unforeseen incidents, contractor coverage provides financial stability, allowing professionals to focus on growth and client service. The advantages of such coverage extend far beyond mere compliance; they empower businesses to operate with confidence, knowing they are protected from potential financial setbacks. As the plumbing sector continues to evolve, the significance of plumbing business insurance only grows, making it an indispensable component of any contractor’s operational strategy.

Moreover, it’s essential to recognize that a dripping faucet can waste an astonishing 3,000 gallons of water annually, illustrating the potential dangers and financial implications of such issues, thereby highlighting the critical need for coverage.

Essential Types of Insurance for Plumbing Businesses

Plumbing companies face the pressing challenge of securing plumbing business insurance that provides a comprehensive range of coverage types, ensuring thorough protection against potential risks. This need is not just a matter of compliance; it’s about safeguarding the well-being of the contractors and their clients. The key types of insurance essential for plumbing contractors include:

- General Liability Insurance: This coverage is vital as it protects against claims of bodily injury and property damage resulting from business operations. Many states mandate that plumbing contractors hold plumbing business insurance due to the public safety hazards linked to their work. This requirement underscores its significance for legal adherence and operational continuity. Understanding and adhering to these regulations is crucial for plumbers to avoid legal issues and ensure seamless operations.

- Workers’ Compensation Coverage: This aspect of plumbing business insurance addresses the medical expenses and lost wages for employees injured on the job. Not only is this coverage a legal requirement in most states, but it is also essential for fostering a safe work environment and protecting the organization from potential lawsuits.

- Commercial Property Coverage: This category of plumbing business insurance safeguards physical assets, including tools, equipment, and the premises, against risks such as theft, fire, or damage. Given the substantial investment in tools that installation companies make, having plumbing business insurance is crucial for financial protection and peace of mind.

- Commercial Auto Coverage: As contractors in the plumbing field frequently depend on vehicles for transporting tools and personnel, plumbing business insurance includes coverage that protects vehicles used for professional purposes. This coverage ensures that both the organization and its employees are safeguarded from accidents and liabilities incurred while on the road.

- Professional Liability Protection: Also known as errors and omissions protection, this safeguard defends against claims of negligence or mistakes in the professional services offered by the plumbing business. For contractors who provide specialized services, having plumbing business insurance is particularly important, as it helps mitigate the financial impact of potential lawsuits.

Understanding the average expenses linked to plumbing business insurance coverage types is vital for effective budgeting. The costs associated with plumbing business insurance can vary significantly depending on factors like company size, location, claim history, and policy limits. For instance, in 2025, contractors in the piping industry can expect to spend an average of $1,200 to $2,500 each year for plumbing business insurance—a small price to pay for the protection it offers.

This variability highlights the importance of careful financial planning, especially when considering plumbing business insurance.

In addition to grasping the types of protection required, plumbing contractors should also recognize the significance of comparing quotes, policy options, and provider reviews when choosing plumbing business insurance. This diligence ensures they find the right coverage tailored to their specific requirements, ultimately enhancing their operational resilience and fostering customer trust. As Joanne Bratton wisely states, “Just as you safeguard your personal vehicles with coverage, it’s necessary to have commercial auto coverage to protect your company’s vehicles and provide safety for you and your employees.”

Moreover, with 79% of clients consistently choosing to receive text messages for marketing or important notifications, effective communication regarding coverage choices can significantly improve customer relations.

Understanding General Liability Insurance for Plumbers

General liability coverage serves as a vital foundation for trade protection, providing a safety net against claims that may arise from incidents resulting in bodily harm or property damage to third parties. Imagine a plumber inadvertently damaging a client’s property while carrying out repairs; in such a scenario, general liability coverage would cover the associated expenses, including repairs and potential legal fees if a lawsuit ensues. This coverage is indispensable for water system businesses, as plumbing business insurance not only mitigates financial risks but also helps maintain a professional reputation in a competitive market.

The significance of general liability coverage is underscored by the reality that the average U.S. household claim for water damage and freezing from 2017 to 2021 was approximately $12,514. This statistic serves as a poignant reminder of the financial repercussions that can occur within the plumbing industry, highlighting the urgent need for plumbing business insurance. Furthermore, companies involved with per- and polyfluoroalkyl substances (PFAS) face heightened liability risks, making comprehensive coverage even more critical.

As illustrated in a case study on risk management strategies, businesses are encouraged to adopt proactive measures to minimize potential incidents related to PFAS exposure. This proactive approach not only safeguards their operations but also fosters a culture of responsibility and care.

Expert opinions affirm that general liability coverage transcends mere regulatory necessity; it is a strategic asset for contractors in the trade. It empowers them to operate with confidence, knowing they are shielded from unforeseen events that could threaten their financial stability. As Jeff Aroff from Legacy Maintenance expressed, “The streamlined access to job-related information emphasizes the platform’s effectiveness in enhancing productivity,” a sentiment that resonates with the operational efficiencies that general liability coverage can facilitate.

As the waterworks sector continues to evolve, grasping the nuances of general liability insurance becomes increasingly essential, especially in 2025, when the landscape of coverage options may shift due to emerging risks and regulatory changes. In light of these developments, contractors are encouraged to embrace proactive risk management strategies, including meticulous documentation and consulting legal counsel for compliance. By adopting these practices, they can streamline the claims process and mitigate potential liabilities, ensuring their operations remain resilient in the face of challenges.

Ultimately, plumbing business insurance is not merely a safety net; it is a crucial component of a contractor’s operational framework, enabling them to concentrate on delivering quality service while safeguarding their financial future.

Workers’ Compensation Insurance: Protecting Your Team

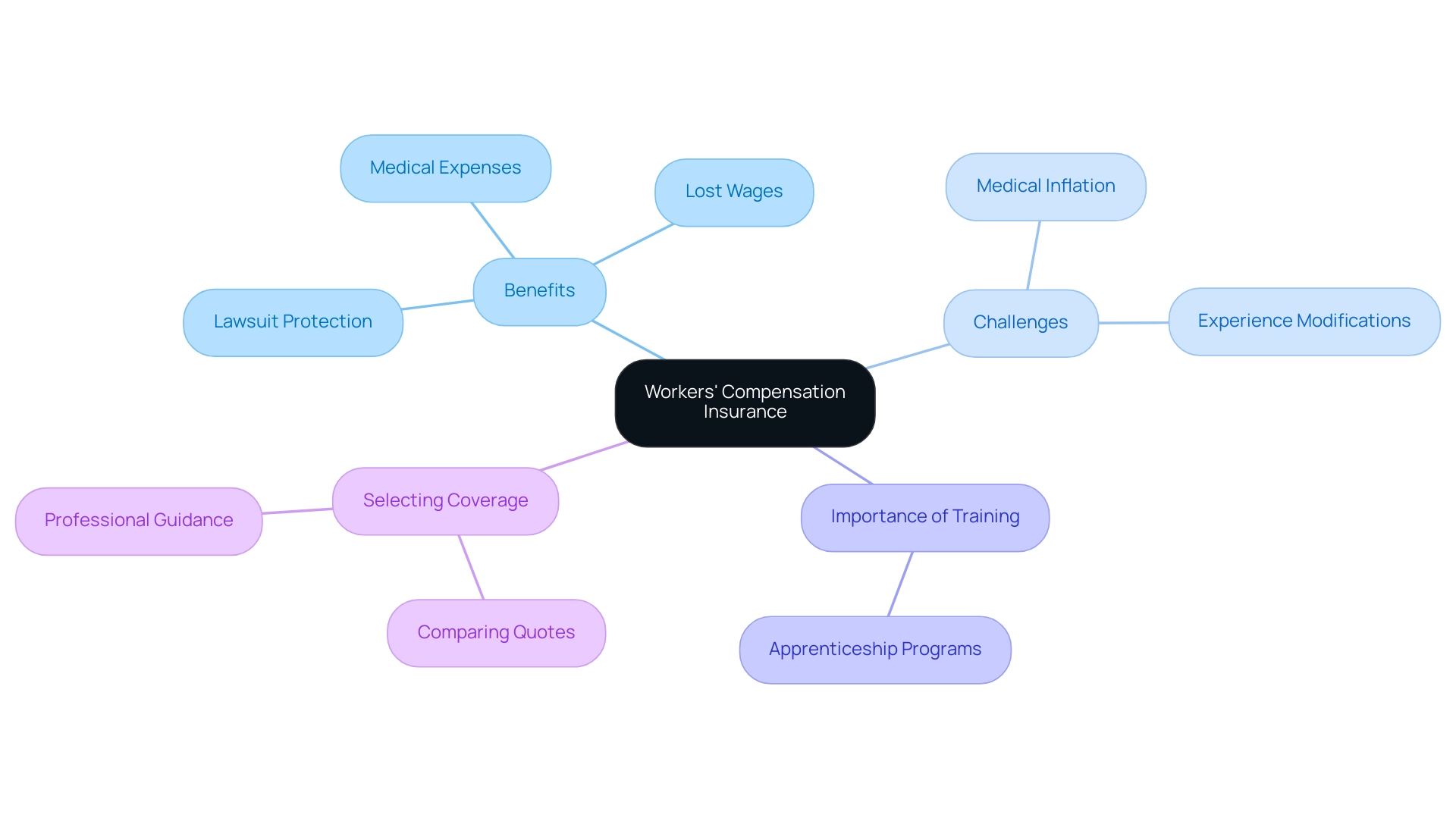

Workers’ compensation protection is essential for plumbing companies, offering crucial coverage for employees who endure work-related injuries or illnesses. This policy not only addresses medical expenses and rehabilitation costs but also compensates for lost wages during recovery periods. Moreover, it safeguards businesses from potential lawsuits arising from workplace injuries, thereby alleviating financial burdens.

Investing in workers’ compensation coverage reflects a contractor’s deep commitment to employee safety and well-being. This dedication can significantly uplift workforce morale and productivity, as employees gain peace of mind knowing they are protected in the event of an accident. Recent findings reveal that effective apprenticeship programs can further reduce workplace injuries, underscoring the importance of thorough training alongside protective measures.

Statistics reveal that the 2024 workers’ compensation rates are 46.6% lower than those effective as of September 30, 2016, presenting a wonderful opportunity for contractors to secure more affordable coverage. However, challenges persist, particularly in states like Wisconsin, where medical inflation is negatively impacting experience modifications and driving up overall costs. This scenario necessitates careful consideration by plumbing contractors when evaluating their business insurance coverage options.

A case study titled ‘Finding the Right Plumbers Coverage Policy’ underscores the importance of diligent research when selecting a provider. Plumbing contractors are encouraged to compare quotes and understand their specific protection needs to ensure they have adequate business insurance for their operations. Engaging with a knowledgeable professional can aid in identifying essential policies and coverage amounts, ultimately fostering business growth.

Expert opinions highlight that workers’ compensation coverage not only protects employees but also nurtures a positive work environment. As Jeff Aroff from Legacy Maintenance observes, “The streamlined access to job-related information” enhances both productivity and safety. By prioritizing safety and providing necessary coverage, contractors in the trade can bolster their reputation and attract skilled workers, further solidifying their position in this competitive industry.

Commercial Property Insurance: Securing Your Business Assets

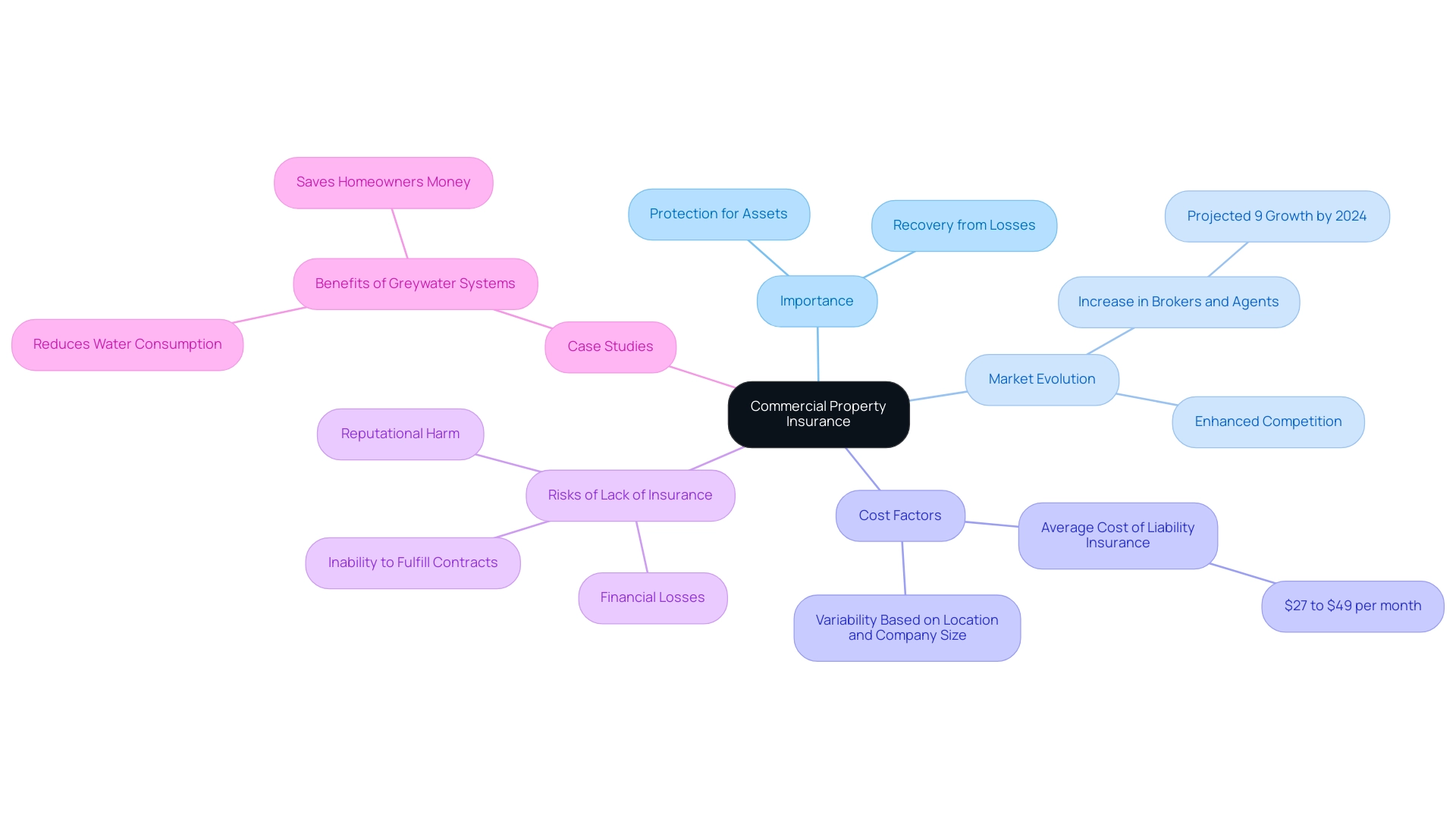

Commercial property coverage serves as a vital shield for service enterprises, protecting essential physical assets such as tools, equipment, and the business location. This type of coverage is crucial for mitigating losses from theft, fire, vandalism, and other unforeseen events that could disrupt operations. For contractors in the piping industry, who often depend on costly tools and specialized equipment, having robust commercial property coverage is not just beneficial; it is essential.

This protection ensures that they can quickly recover from any losses, allowing them to resume operations with minimal financial disruption.

As we look ahead to 2025, the landscape of commercial property protection for plumbing firms is evolving. A growing number of brokers and sales representatives are expected to enter the market, enhancing competition and potentially leading to better options and pricing for contractors. The typical cost of water system protection varies significantly based on factors like location, company size, and coverage limits, with liability coverage typically ranging from $27 to $49 per month. This affordability underscores the importance of investing in comprehensive coverage to safeguard valuable assets.

Moreover, the absence of plumbing business insurance can lead to substantial financial losses for plumbing firms. Statistics reveal that businesses lacking adequate property coverage encounter average losses that can severely affect their bottom line. For instance, plumbing contractors facing theft or damage to their equipment without insurance may find themselves unable to fulfill contracts, resulting in lost revenue and potential reputational harm.

Indeed, as Jeff Aroff noted, ‘the streamlined access to job-related information’ can significantly enhance productivity, which is directly tied to the financial benefits of having sufficient protection.

Real-world examples illustrate the critical role of commercial property coverage. Case studies show that contractors who have invested in this protection are better equipped to handle unforeseen events, ensuring continuity of service and client satisfaction. As the sector adapts to new challenges, regularly assessing protection needs is essential for companies in the trade to maintain adequate support and avoid excessive costs.

By prioritizing plumbing business insurance, pipe fitting contractors can protect their assets and secure their financial future.

Additional Coverage Options for Plumbing Businesses

In addition to the essential insurance types, plumbing businesses should thoughtfully consider several additional coverage options to further safeguard their operations, recognizing the unique challenges they face:

- Professional Liability Insurance: This crucial coverage protects against claims of negligence or errors in the services provided, offering peace of mind. It’s particularly important for contractors who provide specialized services, ensuring they are covered in the event of disputes arising from their work.

- Commercial Auto Insurance: For businesses that rely on vehicles for work purposes, this insurance is not just beneficial—it’s essential. It covers accidents and liabilities associated with company vehicles, providing vital protection for contractors while they navigate the roads.

- Tools and Equipment Insurance: Given that tools and equipment are the lifeblood of pipefitting operations, this coverage shields against loss or damage. Statistics from 2025 indicate that a significant proportion of trade services recognize the importance of this coverage, as it alleviates the financial burden of replacing or repairing essential equipment.

- Interruption Insurance: This insurance is designed to cover lost income and operating expenses if the organization is temporarily unable to operate due to a covered event, such as a natural disaster. With 40% of all payments handled online in 2023, having this coverage can be a lifesaver for trade enterprises facing unexpected disruptions. Moreover, as 79% of customers regularly opt-in to text messages for marketing or important reminders, effective communication can play a crucial role in maintaining customer relations during such trying times.

- Sustainability Coverage Alternatives: As sustainability trends in the field continue to evolve, specialized policies may become necessary to cover eco-friendly practices and technologies. This contemporary viewpoint can help water supply companies align their operations with current market demands, fostering a sense of responsibility and community engagement.

By understanding and investing in plumbing business insurance alongside these supplementary coverage options, contractors in the pipefitting sector can enhance their operational resilience and pave the way for long-term business growth. Furthermore, utilizing Field Complete’s features can simplify job management, allowing contractors to efficiently create, edit, and schedule jobs from any device, thereby reducing paperwork and enhancing productivity. Case studies illustrate that collaborating with a qualified expert can assist plumbing contractors in identifying essential policies and amounts of plumbing business insurance, ensuring they have adequate protection tailored to their unique needs.

The process of selecting the right policy involves researching providers, comparing quotes, and understanding coverage needs, as underscored in the case study titled “Finding the Right Plumbers Coverage Policy.” Additionally, as Jeff Aroff noted, having streamlined access to job-related information emphasizes the platform’s effectiveness in boosting productivity, which is essential for managing operational tools efficiently.

Factors Affecting Plumbing Business Insurance Costs

The cost of plumbing business insurance can be a daunting challenge for many contractors, influenced by several key factors that may vary significantly based on individual circumstances.

- Business Size: For larger plumbing businesses, the burden of higher premiums often weighs heavily. This stems from their increased risk exposure, as larger operations typically handle more jobs and clients, which can lead to a greater likelihood of claims.

- Location: The geographical area in which a plumbing business operates plays a crucial role in determining coverage rates. Regions with higher claim frequencies or specific regulatory requirements may experience elevated premiums, reflecting the local risk environment and adding to the stress of managing costs.

- Coverage Limits: The boundaries of protection chosen directly influence insurance expenses. Generally, opting for higher coverage limits can lead to increased premiums, as they elevate the insurer’s potential payout in the event of a claim, which can feel overwhelming for many contractors.

- Claims History: A company’s claims history in the waterworks sector is a significant factor in premium calculations. Frequent claims can categorize a business as a higher risk, prompting insurers to raise premiums to mitigate potential losses, further complicating the financial landscape for contractors.

- Type of Work: The particular services related to pipes can also influence coverage expenses. Businesses that provide specialized services may incur higher premiums due to the increased risks associated with those tasks, adding another layer of complexity.

Moreover, the absence of funding for employee training or safety gear can lead to more frequent accidents and claims, subsequently impacting coverage expenses. Understanding these factors is crucial for plumbing contractors aiming to manage their insurance costs effectively. As Jeff Aroff from Legacy Maintenance insightfully noted, operational efficiency is vital in boosting productivity, which can also help in managing costs.

Investigating and contrasting policy estimates, along with seeking advice from qualified professionals, can assist in identifying essential plans and protection amounts, ensuring sufficient safeguarding for growth. The case study titled ‘Finding the Right Insurance Policy’ illustrates the importance of researching providers and comparing quotes, reinforcing these actions as essential steps for related enterprises. By taking these steps, pipe service providers can navigate the complexities of coverage costs and secure the protection that best fits their operational needs.

Choosing the Right Insurance Policy for Your Plumbing Business

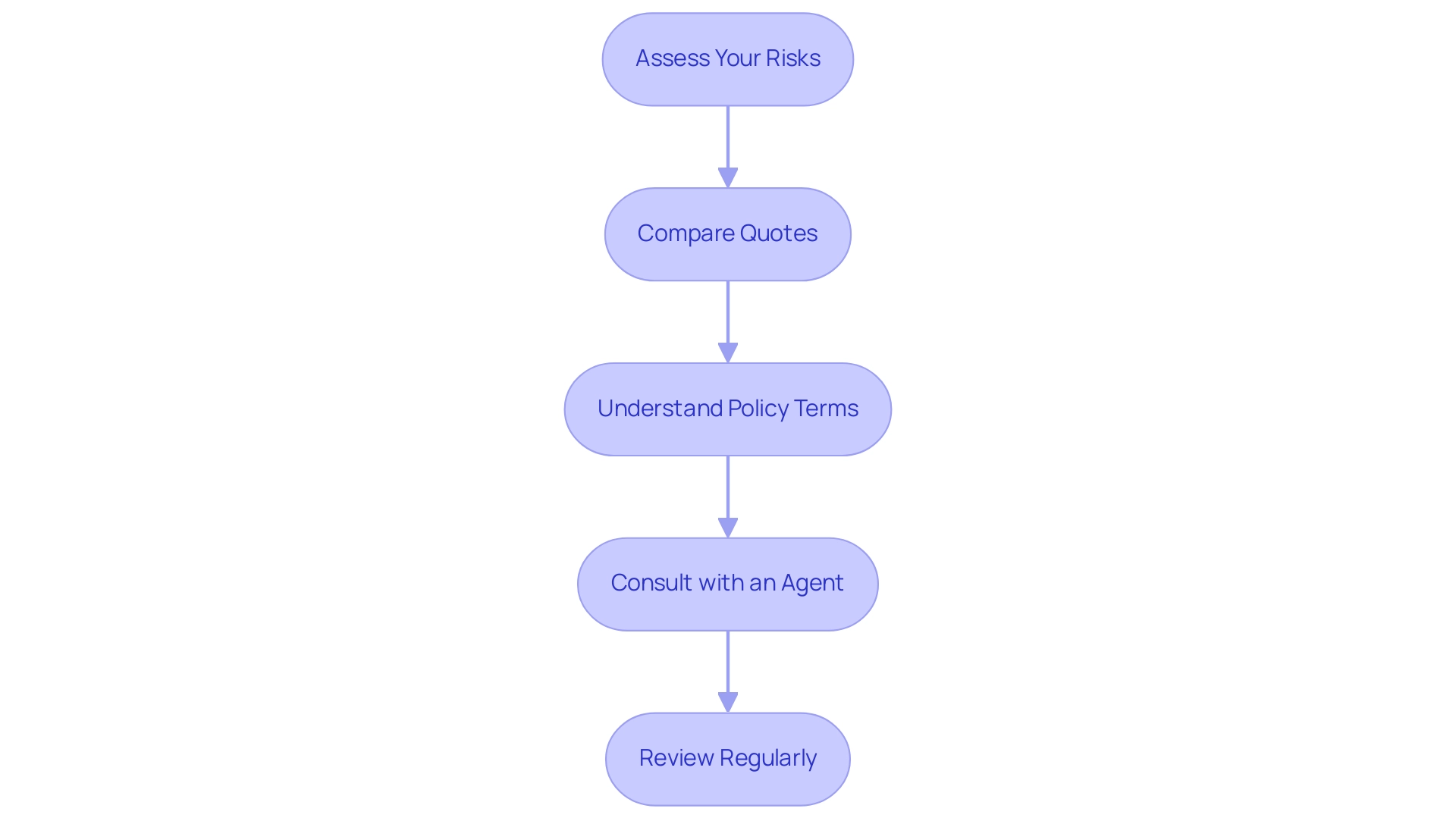

Selecting the right insurance policy for a plumbing business in 2025 can feel overwhelming, but taking a strategic approach can ease this burden. Here are several essential steps to guide you through the process:

- Assess Your Risks: Begin by identifying the specific risks associated with your plumbing operations. This includes evaluating potential liabilities such as property damage, bodily injury, and equipment loss. Understanding these risks is crucial, as it will help you determine the necessary levels of protection, ensuring your business is safeguarded against unexpected challenges.

- Compare Quotes: It’s vital to obtain quotes from multiple insurance providers. This not only helps you find the best rates but also allows you to compare protection options that suit your unique needs. Researching providers who understand the specific requirements of plumbing contractors can lead to more tailored policies. Remember, dedicating time to compare quotes is essential for securing the best protection for your enterprise.

- Understand Policy Terms: Carefully review the terms and conditions of each policy. Pay attention to limit stipulations, exclusions, and deductibles to ensure the policy aligns with your business needs. For instance, in Illinois, plumbing contractors are required to have a minimum of $100,000 in general liability coverage, $300,000 for bodily injury, and $50,000 for property damage. This knowledge empowers you to make informed decisions about your coverage.

- Consult with an Agent: Engaging with an experienced agent can provide valuable insights. They can help you navigate the complexities of policies and customize a plan that suits your unique needs, ensuring you are adequately protected. Their expertise can be a reassuring resource as you make these important decisions.

- Review Regularly: As your business evolves, so too should your coverage. Periodically reassess your insurance needs to ensure you maintain adequate protection, especially as you expand your services or take on new projects. This proactive approach can prevent gaps in coverage that may leave you vulnerable.

In addition to these steps, it’s important to consider the increasing demand for sustainable piping solutions. According to Nitin Khanna, the demand for plumbers is expected to remain steady, driven by a growing construction industry and increasing maintenance needs. This trend not only presents opportunities for growth but also necessitates specific coverage considerations to protect your business.

For instance, as the piping market continues to grow due to persistent construction and maintenance requirements, possessing the appropriate coverage can shield your enterprise from unexpected obstacles.

Additionally, insights from the case study titled “Starting a Plumbing Venture: A Practical Guide” highlight the significance of planning and strategy in establishing a successful trade. By following these steps and leveraging expert insights, contractors in the field can make informed choices about their coverage policies, ensuring they are well-equipped to handle the risks associated with their operations.

Debunking Myths About Plumbing Business Insurance

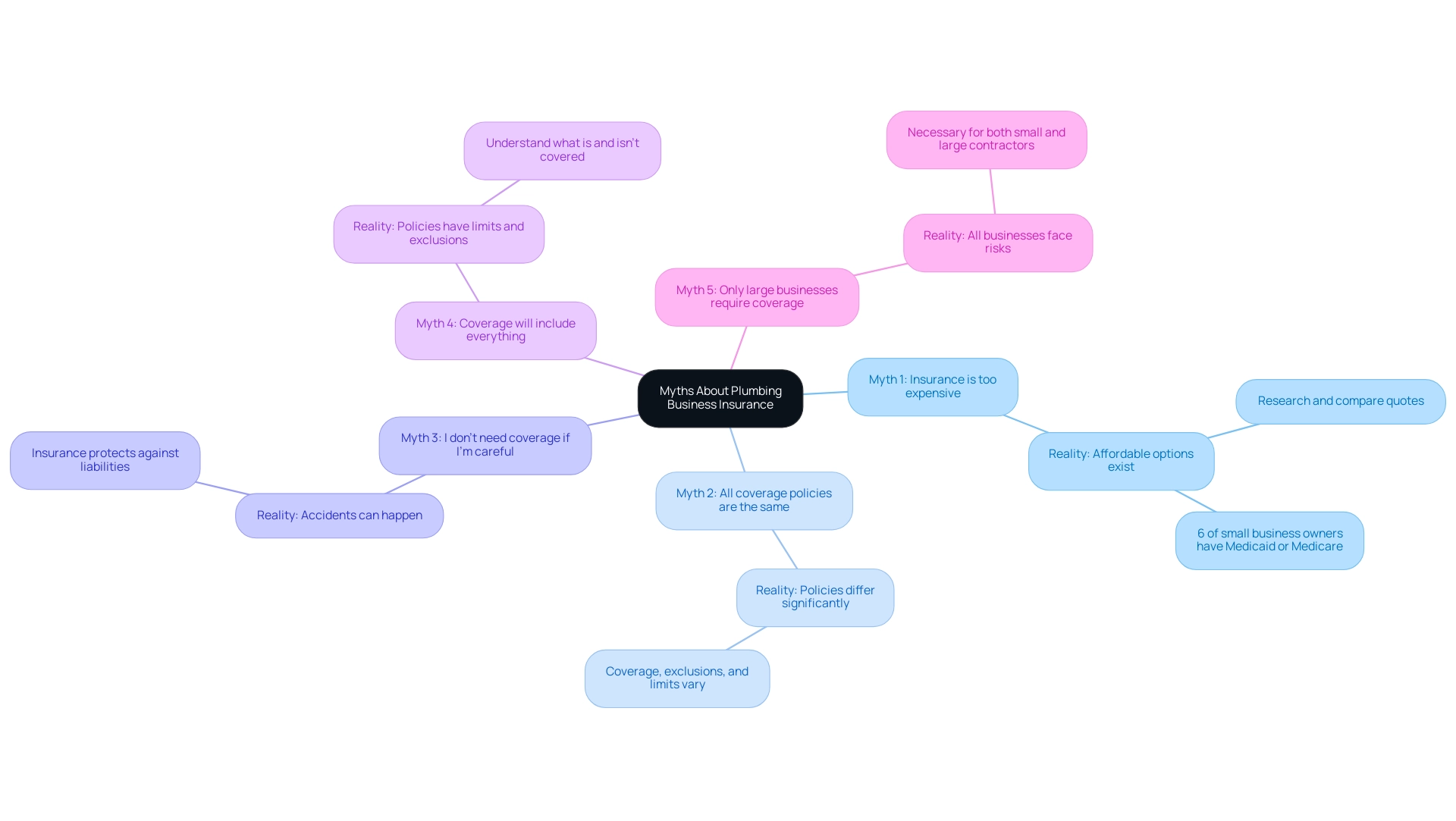

Many misconceptions regarding trade protection coverage can lead to confusion, ultimately resulting in misguided choices among contractors. Understanding these misconceptions is crucial for ensuring adequate protection for your enterprise. Let’s explore some prevalent myths together:

- Myth 1: Insurance is too expensive: While it’s true that insurance costs can vary widely, there are many affordable options available that provide essential coverage tailored to the needs of plumbing businesses. Taking the time to research and compare quotes is vital in finding the right policy that fits your budget without compromising necessary protection. In fact, statistics indicate that 6% of small business owners have Medicaid or Medicare, highlighting the diverse coverage landscape that exists for small enterprises.

- Myth 2: All coverage policies are the same: This is a common misconception. In reality, protection plans can differ significantly in terms of coverage, exclusions, and limits. It’s essential to thoroughly compare different options to ensure you select a policy that adequately addresses your specific risks and needs.

- Myth 3: I don’t need coverage if I’m careful: Even the most cautious contractors can encounter accidents or unforeseen events. Having plumbing business insurance is essential for safeguarding your enterprise against potential liabilities that may arise from accidents, property damage, or other incidents.

- Myth 4: Coverage will include everything: Many entrepreneurs mistakenly believe that their coverage will address all potential situations. However, policies come with limits and exclusions, making it vital to understand what is and isn’t covered to avoid unexpected gaps in protection.

- Myth 5: Only large businesses require coverage: This misconception overlooks the reality that all enterprises in the plumbing sector, regardless of size, face risks that could lead to significant financial loss. Plumbing business insurance is a necessary safeguard for both small and large contractors, helping to mitigate risks associated with daily operations.

Addressing these misconceptions is essential for plumbing contractors to make informed choices about their insurance coverage needs. As the industry evolves, with nearly 25% of plumbers expected to be over the age of 55 by 2024, understanding the importance of comprehensive coverage becomes even more critical. Expert insights emphasize that investing in appropriate coverage not only protects your enterprise but also enhances customer confidence and satisfaction.

As Kevin S. Dougherty, a professional in the field, states, “we offer best-in-class business coverage that protects your business from liability claims, property damage, advertising injuries, and other potential risks.” Furthermore, effective communication, as illustrated by Jobber’s case study on customer retention through text messaging, can enhance customer satisfaction and underscores the importance of having proper insurance coverage to protect against potential liabilities.

Conclusion

Plumbing business insurance is not merely a requirement; it is a vital investment for contractors, acting as a protective shield against the myriad of risks that can disrupt daily operations. From general liability and workers’ compensation to commercial property coverage, each type of insurance is essential in safeguarding assets, employees, and the overall financial health of the business. It is crucial to understand the nuances of these insurance options, especially as the industry navigates evolving challenges and regulatory changes.

Navigating the complexities of insurance costs can feel overwhelming. Factors such as business size, location, claims history, and the specific services offered can significantly influence premium rates. By thoughtfully assessing these factors and comparing quotes from various providers, plumbing contractors can find the coverage that best aligns with their operational needs while effectively managing expenses.

Moreover, debunking common myths surrounding plumbing business insurance is essential for informed decision-making. It’s important to recognize that affordable and tailored insurance options are available. Understanding the differences between policies empowers contractors to make informed choices that protect their businesses against unforeseen liabilities.

In conclusion, prioritizing comprehensive plumbing business insurance transcends regulatory compliance; it is a strategic necessity that enhances credibility, promotes employee safety, and ultimately fosters long-term growth. By investing in the right coverage and maintaining a proactive approach to risk management, plumbing contractors can operate with confidence, ensuring their businesses remain resilient and competitive in an ever-changing landscape.

Frequently Asked Questions

Why is plumbing business insurance important for contractors?

Plumbing business insurance is vital for contractors as it offers essential protection against various hazards encountered during daily operations, providing financial security against claims related to accidents, property damage, and injuries.

What are the financial implications of not having plumbing business insurance?

Without adequate protection, a single incident, such as a pipe failure, can incur substantial costs that may jeopardize a business, highlighting the importance of having insurance coverage.

How does plumbing business insurance impact a company’s reputation?

Having plumbing business insurance enhances a company’s reputation, as clients are more likely to engage contractors who demonstrate a commitment to professionalism and responsibility through their insurance coverage.

What types of coverage are essential for plumbing contractors?

Essential types of coverage for plumbing contractors include: General Liability Insurance, Workers’ Compensation Coverage, Commercial Property Coverage, Commercial Auto Coverage, and Professional Liability Protection.

What does General Liability Insurance cover?

General Liability Insurance protects against claims of bodily injury and property damage resulting from business operations, which is crucial for legal compliance and operational continuity.

What is the purpose of Workers’ Compensation Coverage?

Workers’ Compensation Coverage addresses medical expenses and lost wages for employees injured on the job, and it is a legal requirement in most states.

What does Commercial Property Coverage protect?

Commercial Property Coverage safeguards physical assets, such as tools and equipment, against risks like theft, fire, or damage, ensuring financial protection for contractors.

Why is Commercial Auto Coverage important for plumbing businesses?

Commercial Auto Coverage protects vehicles used for professional purposes, ensuring that both the organization and its employees are safeguarded from accidents and liabilities incurred while on the road.

What is Professional Liability Protection?

Professional Liability Protection defends against claims of negligence or mistakes in the professional services offered by the plumbing business, making it particularly important for contractors providing specialized services.

How much can plumbing contractors expect to spend on business insurance in 2025?

In 2025, plumbing contractors can expect to spend an average of $1,200 to $2,500 annually for plumbing business insurance, depending on factors like company size and claim history.

What should plumbing contractors consider when choosing insurance?

Contractors should compare quotes, policy options, and provider reviews to find the right coverage tailored to their specific requirements, enhancing their operational resilience and fostering customer trust.

What are the benefits of having plumbing business insurance beyond compliance?

Beyond compliance, plumbing business insurance empowers businesses to operate with confidence, focus on growth and client service, and protect against potential financial setbacks.