Overview

HVAC insurance is truly vital for contractors, offering specialized protection against the myriad risks they encounter, such as property damage, bodily injury, and the legal liabilities that can arise during their operations. It’s important to recognize that this coverage not only helps safeguard financial stability and ensures compliance with industry standards, but it also plays a crucial role in enhancing operational efficiency. In a competitive market, where the success of contractors hinges on effective risk management and reliable service delivery, having this support can make all the difference.

Introduction

In the competitive landscape of HVAC contracting, where nearly a million establishments operate across the U.S., the significance of specialized insurance is truly profound. For HVAC contractors, this insurance acts as a vital safety net, offering protection against a wide array of risks—ranging from equipment failures and job site accidents to property damage and environmental hazards. As the industry faces the pressing challenges of a shortage of skilled technicians and rising operational costs, securing comprehensive insurance coverage becomes an essential strategy for achieving financial stability and operational resilience.

This article explores the fundamental types of insurance that HVAC contractors require, the unique risks they encounter, and the importance of regularly reviewing their coverage to meet the evolving demands of the marketplace. By understanding these critical elements, contractors not only safeguard their businesses but also enhance their ability to thrive in a rapidly changing environment. Together, let us navigate these challenges and discover the peace of mind that comes with being well-protected.

What is HVAC Insurance and Why is it Essential for Contractors?

This coverage represents a specialized form of commercial protection, known as , thoughtfully designed to safeguard professionals in heating, ventilation, and air conditioning from the myriad risks associated with their vital operations. provides essential protection against property damage, bodily injury, and legal liabilities that may arise during . For builders, securing adequate transcends mere regulatory necessity; it is a fundamental safeguard for their and operational integrity.

In 2020, the U.S. was home to nearly 990,000 plumbing and heating ventilation air conditioning service establishments, underscoring the industry’s expansive scale and the potential risks that accompany it. This vast number of establishments intensifies competition, making it crucial for builders to manage risks effectively through comprehensive coverage. Compounding these challenges is a pressing shortage of qualified technicians, with an estimated deficit of around 110,000 professionals.

This shortage not only prolongs repair times but also escalates operational expenses, further emphasizing the significance of climate control coverage in addressing these hurdles. Moreover, through effective field service management is vital for heating and cooling professionals. Research from Aberdeen Group reveals that even a modest 5% increase in the attach rate can lead to an impressive 9% increase in income, highlighting the financial advantages of maintaining robust contracts and service agreements.

Additionally, studies indicate that just one extra onsite visit per week can nearly double job satisfaction, reinforcing the importance of . As builders focus on cultivating stable revenue sources, HVAC insurance becomes indispensable for protecting against unforeseen liabilities while enabling efficient operations that can lead to a higher attach rate. The importance of climate control coverage is further underscored by recent findings from the Climate Control EBITDA & Valuation Multiples – 2025 Report, which reveals that residential climate control firms are outperforming their commercial counterparts.

This trend accentuates the necessity for contractors to not only secure sufficient coverage but also to enhance through advanced scheduling, estimating, and invoicing features. As Jeff Aroff from Legacy Maintenance notes, having significantly boosts productivity and operational efficiency, which is critical for effective risk management in the heating, ventilation, and air conditioning sector. Furthermore, endorsements from industry experts highlight the crucial role of HVAC insurance in covering heating and cooling systems.

Looking ahead to 2025, the benefits of climate control coverage for builders are clearer than ever, as it not only protects against financial setbacks but also fosters a more robust business strategy capable of thriving in a competitive marketplace. In summary, HVAC insurance coverage is vital for builders in 2025, offering essential protection against various risks while ensuring compliance with industry standards. By investing in comprehensive protection plans and adopting efficient service management techniques, heating and cooling professionals can safeguard their financial interests and focus on delivering quality service to their clients.

Key Types of Insurance Coverage for HVAC Contractors

face significant challenges that can impact their businesses and the well-being of their teams. It’s essential to prioritize several forms of protection to safeguard against these challenges effectively.

- is one of the most critical coverages. It protects against claims of bodily injury or property damage that may arise from a worker’s operations. In 2025, the typical expense of general liability coverage for builders can vary greatly, but investing in this protection is vital to mitigate potential financial losses from lawsuits.

- is another crucial policy that addresses medical costs and lost earnings for workers injured on the job. With the heating, ventilation, and air conditioning sector expected to see substantial job openings due to retirements and the increasing complexity of climate-control systems, ensuring that workers are safeguarded is paramount. In fact, the heating and cooling industry employs around 397,450 technicians and installers in the U.S., underscoring the importance of .

- is essential as heating and cooling professionals often rely on vehicles to transport equipment and staff. This coverage provides vital support for vehicles used in business activities, safeguarding against accidents and damages, and ensuring that builders can maintain operations without disruption.

- defends against claims of negligence or mistakes in a worker’s tasks. As the heating and cooling industry evolves, the complexity of projects increases, making this protection increasingly significant for builders who wish to shield themselves from potential claims.

- is also critical, as tools and machinery are vital assets for heating and cooling professionals. This coverage protects against loss or damage to these essential items, allowing builders to replace or repair tools without incurring substantial personal costs.

Understanding these coverage categories is crucial for HVAC professionals to protect their business resources and ensure compliance with legal obligations related to . The industry faces challenges like technician shortages, which could lead to revenue losses projected at $250,000 annually. Having the right coverage can provide peace of mind and .

Moreover, consider the impact of unforeseen events; one of my employees accidentally opened a spam email, which turned out to be a phishing attack. This incident resulted in a delay in work orders due to , highlighting the dangers that heating and cooling professionals encounter and the importance of coverage in alleviating such problems.

By investing in comprehensive protection, HVAC professionals can focus on growth and client satisfaction while minimizing the risks associated with their operations.

Understanding the Risks: Why HVAC Contractors Need Specialized Insurance

Heating and cooling professionals encounter a range of distinct risks that underline the importance of specialized insurance protection. These risks include:

- Equipment Failure: The complex nature of HVAC systems can lead to failures, resulting in significant repair costs and potential liability claims. With over 70% of U.S. homes equipped with air conditioning units, the demand for maintenance and repairs is considerable, creating a market filled with service opportunities. However, this also exposes workers to financial risks associated with equipment malfunctions.

- Job Site Accidents: The operation of heavy machinery and tools on job sites heightens the likelihood of accidents, which can lead to serious injuries. In 2025, statistics reveal that , making robust insurance policies essential for mitigating the financial repercussions of such incidents.

- Property Damage: During installation or repair work, there is a risk of inadvertently causing damage to a client’s property. This not only affects the builder’s reputation but can also result in costly claims, emphasizing the need for specialized coverage to protect against potential liabilities.

- Environmental Risks: HVAC work often involves handling refrigerants and other materials that pose environmental hazards. As the phase-out of refrigerant R410-A in favor of R-32 and R-454B begins on January 1, 2025, professionals must be mindful of the implications for their operations and the associated risks, complicating their insurance needs further.

- Market Demand: , with searches increasing by 20% year-over-year. This trend highlights the growing need for these services, along with the challenges that service providers must navigate.

To thrive in this challenging environment, heating and cooling professionals can leverage streamlined like . This software facilitates efficient job creation, scheduling, and organization. Its and in-app messaging features enhance operational efficiency, while customizable templates for estimates and real-time approval alerts ensure accuracy and promptness in client interactions. Furthermore, integrated payment solutions streamline transactions, reducing delays and improving cash flow, which is vital for managing the financial aspects of their operations.

Given these multifaceted risks, specialized insurance is not just advantageous but essential for heating and cooling professionals. It protects their businesses against unforeseen challenges, ensuring long-term sustainability in a competitive market. As Terence Chan, owner of Impetus Plumbing and Heating, wisely advises, “My advice is to lean into learning a new skill, do the hard work that’s required, and in the end you become a master at the craft.”

This insight underscores the importance of understanding the protective measures necessary to flourish in the industry. Additionally, the case study titled ‘Market Potential for ‘ indicates that , reinforcing the need for professionals to be prepared for the risks associated with this expanding market. The increasing popularity of heat pumps as a sustainable alternative also contributes to lower operational costs and reduced greenhouse gas emissions, further shaping the landscape of heating and cooling services and the related risks.

Navigating the Costs: How Much Does HVAC Insurance Really Cost?

Understanding the cost of can be overwhelming for contractors, but it’s crucial to navigate this landscape with care. Various factors influence these costs, and recognizing them can significantly ease the burden. Key determinants include:

- : Larger HVAC businesses often face higher premiums due to the increased risk associated with more employees and operations. This can create a sense of anxiety as costs rise.

- : The level of protection you choose plays a vital role in determining your expenses. Basic policies might start around $50 per month, but comprehensive coverage can soar to several thousand dollars annually, depending on your specific needs.

- : Your claims history is a significant factor in your premiums. Contractors with frequent claims may feel the weight of higher costs, as they are often viewed as higher risk.

- Location: Where your business operates can also affect your coverage rates, as local regulations and environmental risks differ widely.

In 2025, HVAC professionals can expect their insurance costs to range from $300 to $10,000 each year, influenced by their unique operational requirements and risk assessments.

To manage and potentially lower these costs, contractors can take proactive steps. Establishing and ensuring accurate worker classifications can significantly reduce Workers’ Compensation premiums. For instance, the case study titled “” reveals that businesses can cut their coverage costs by implementing safety programs, ensuring correct worker classification, inquiring about available discounts, and maintaining a clean claims history.

Furthermore, regular training and the use of personal protective equipment (PPE) are crucial in minimizing accident risks, which can lead to over time.

As Marina Pettit insightfully points out, “They support you in maintaining your heating and cooling business running smoothly and worry-free.” This highlights the importance of effective management practices in navigating these challenges. By understanding these elements and actively overseeing their HVAC insurance strategies, heating and cooling professionals can protect their businesses while enhancing their financial management and .

Additionally, leveraging advanced technology like can simplify scheduling, estimating, and payment collection, allowing contractors to improve operational efficiency. This empowers teams to complete more jobs per technician, ultimately driving revenue growth.

This streamlined approach to business management not only helps contractors manage their expenses more effectively but also paves a smoother path to financial success. Discover how Field Complete can revolutionize and assist in managing your expenses effectively—try it FREE today.

The Importance of Regularly Reviewing Your HVAC Insurance Coverage

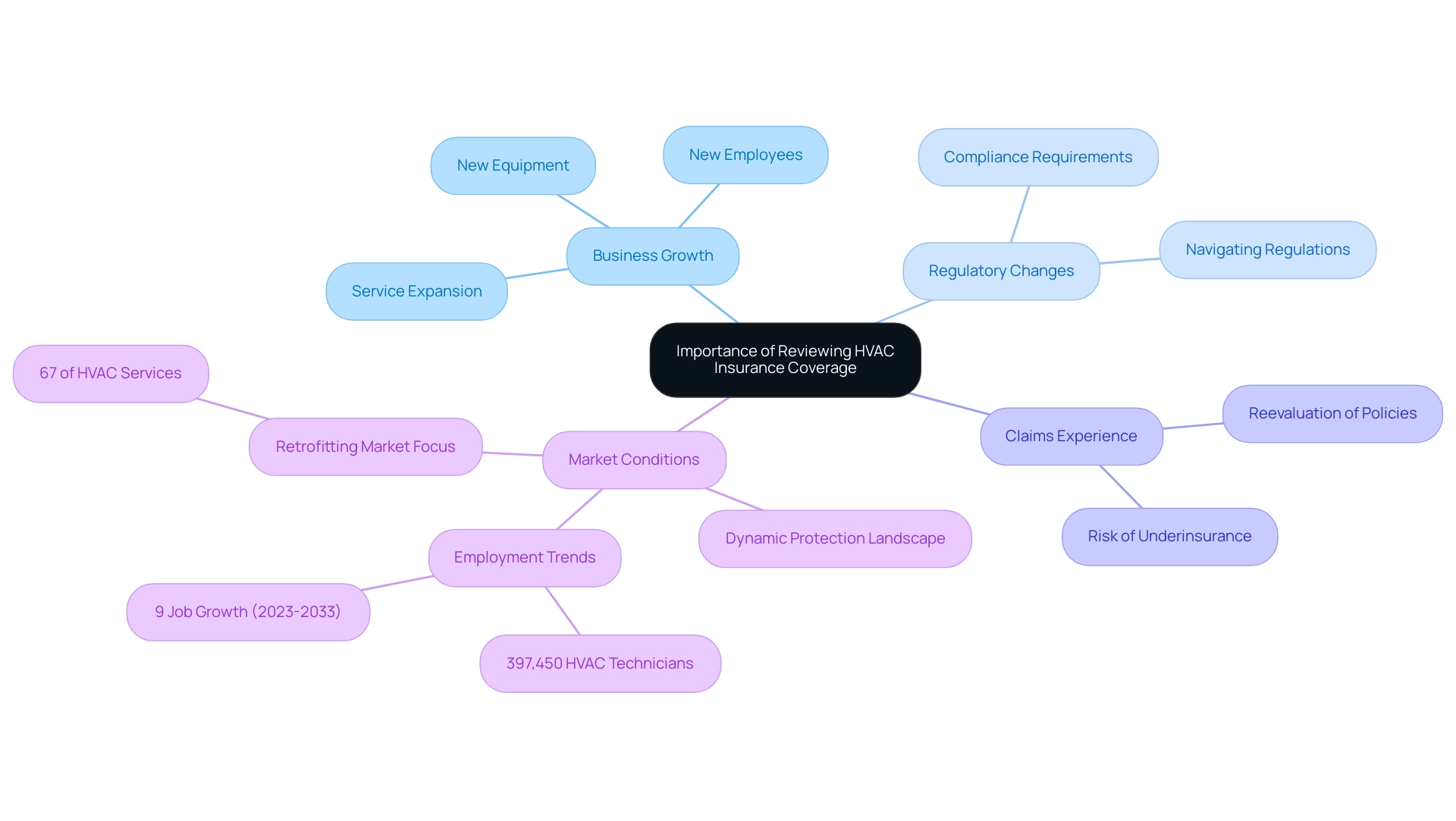

Consistently evaluating your protection is crucial for several important reasons, and we understand how overwhelming this can feel:

- Business Growth: As your heating and cooling enterprise grows, your protection needs may change. The addition of new employees, equipment, or services can necessitate enhanced protection to . It’s vital to recognize that these changes can bring about stress and uncertainty.

- Regulatory Changes: The HVAC industry is subject to various laws and regulations that can change over time. Remaining compliant frequently necessitates revisions to your protection plans, ensuring that you are safeguarded against possible liabilities. We know that navigating these regulations can be daunting.

- Claims Experience: If your business has submitted claims, it’s essential to reevaluate your protection. This evaluation assists in confirming that your policies continue to satisfy your requirements and shields you from the danger of underinsurance, which can be harmful in the case of a substantial loss. It’s natural to feel anxious about the potential consequences of being underprepared.

- Market Conditions: The , with rates and available options fluctuating. Occasionally exploring options can uncover improved rates or more extensive protection, ultimately aiding your finances. We understand that finding the best coverage can sometimes feel like a full-time job.

In 2025, the heating and cooling sector is anticipated to experience ongoing expansion, with roughly 397,450 technicians and installers employed throughout the U.S. This expansion highlights the significance of having sufficient that is customized to your changing business requirements. Additionally, with 67% of the HVAC services market concentrated on retrofitting current systems, builders must ensure their policies address the specific risks linked to these projects.

Expert views stress that are not merely a best practice but an essential requirement for HVAC professionals. By conducting these reviews, you can ensure that your scope aligns with your business’s current operations and growth trajectory, ultimately protecting your investment and enhancing operational efficiency, especially in terms of HVAC insurance. Case studies have demonstrated that builders who participate in regular policy evaluations are better equipped to manage the complexities of the industry, especially in states witnessing substantial growth such as Florida, California, and Texas.

Furthermore, it is essential to acknowledge the safety implications of insufficient protection. In 2020, there were 1,778 fatalities from , emphasizing the necessity of having strong liability protection to guard against such risks. We care deeply about the safety of every contractor and worker in this field.

Moreover, in the New York-Newark-Jersey City region alone, there are 22,780 heating, ventilation, and air conditioning workers, signifying a considerable local workforce that needs adequate protection. As the HVAC industry continues to grow, with a projected job growth of 9% from 2023 to 2033, their HVAC insurance to ensure it meets the needs of their expanding workforce. In summary, a proactive approach to reviewing HVAC insurance coverage is vital for safeguarding your business against unforeseen challenges and ensuring compliance with industry standards. Remember, you are not alone in this journey; we are here to support you every step of the way.

Conclusion

The significance of specialized HVAC insurance for contractors truly cannot be overstated. This essential coverage acts as a vital safety net, protecting businesses from a myriad of risks such as equipment failures, job site accidents, and property damage. In a time when the HVAC industry is grappling with a shortage of skilled technicians and rising operational costs, having comprehensive insurance is not merely a regulatory requirement; it has become a strategic necessity for maintaining both financial stability and operational resilience.

It is crucial for HVAC contractors to understand the various types of insurance available—ranging from general liability and workers’ compensation to commercial auto and professional liability. Each of these coverage types addresses distinct risks that are inherent to the industry, ensuring that contractors can operate without the constant worry of unforeseen financial burdens. Regularly reviewing these policies is equally important, as changes in business size, regulatory environments, and market conditions can necessitate adjustments to coverage.

In a rapidly evolving market, staying informed and proactive about insurance needs empowers HVAC contractors to navigate challenges effectively. By investing in adequate insurance and adopting sound business practices, contractors can protect their assets, enhance their operational efficiency, and ultimately thrive in an increasingly competitive landscape. As the HVAC industry continues to grow, prioritizing specialized insurance will be key to safeguarding businesses and fostering long-term success.

Frequently Asked Questions

What is HVAC insurance and why is it important?

HVAC insurance is a specialized form of commercial protection designed to safeguard professionals in heating, ventilation, and air conditioning from risks such as property damage, bodily injury, and legal liabilities during service delivery. It is essential for financial security and operational integrity in the HVAC industry.

How many HVAC service establishments were there in the U.S. in 2020?

In 2020, there were nearly 990,000 plumbing and heating ventilation air conditioning service establishments in the U.S.

What challenges does the HVAC industry currently face?

The HVAC industry faces significant challenges, including a shortage of qualified technicians, with an estimated deficit of around 110,000 professionals, which leads to prolonged repair times and increased operational expenses.

How can HVAC insurance enhance profitability for service providers?

Effective field service management can enhance service profitability. Research indicates that even a 5% increase in the attach rate can lead to a 9% increase in income, underscoring the financial benefits of maintaining robust contracts and service agreements.

What role does job satisfaction play in the HVAC industry?

Studies show that just one extra onsite visit per week can nearly double job satisfaction, highlighting the importance of effective service management in the HVAC sector.

What types of coverage should HVAC professionals prioritize?

HVAC professionals should prioritize several forms of protection, including: General Liability Insurance, Workers’ Compensation Coverage, Commercial Vehicle Protection, Professional Liability Coverage, and Equipment Insurance.

What is the significance of General Liability Insurance for HVAC builders?

General Liability Insurance protects against claims of bodily injury or property damage that may arise from a worker’s operations, making it vital for mitigating potential financial losses from lawsuits.

Why is Workers’ Compensation Coverage crucial for HVAC professionals?

Workers’ Compensation Coverage addresses medical costs and lost earnings for workers injured on the job, which is especially important in an industry with a large workforce and increasing job openings.

How does Commercial Vehicle Protection benefit HVAC professionals?

Commercial Vehicle Protection safeguards vehicles used for business activities against accidents and damages, ensuring that builders can maintain operations without disruption.

What is Professional Liability Coverage and why is it important?

Professional Liability Coverage defends against claims of negligence or mistakes in a worker’s tasks, becoming increasingly significant as the complexity of HVAC projects grows.

How does Equipment Insurance support HVAC professionals?

Equipment Insurance protects against loss or damage to essential tools and machinery, allowing builders to replace or repair these items without incurring substantial personal costs.

What are the potential financial consequences of not having adequate HVAC insurance?

Without adequate HVAC insurance, professionals may face significant financial setbacks from lawsuits, operational disruptions, and the inability to recover costs associated with damaged or lost equipment, potentially leading to revenue losses.

List of Sources

- What is HVAC Insurance and Why is it Essential for Contractors?

- HVAC EBITDA & Valuation Multiples – 2025 Report – First Page Sage (https://firstpagesage.com/business/hvac-ebitda-valuation-multiples)

- HVAC System Market Size, Trends & Forecast 2025-2034 (https://thebusinessresearchcompany.com/report/hvac-system-global-market-report)

- HVAC industry statistics 2025 (https://consumeraffairs.com/homeowners/hvac-industry-statistics.html)

- 75+ HVAC Facts and Statistics You Need to Know in 2025 (w/ Infographic!) (https://workyard.com/construction-management/hvac-facts-statistics)

- Key Types of Insurance Coverage for HVAC Contractors

- HVAC Insurance for Businesses (https://thehartford.com/business-insurance/hvac-insurance)

- 75+ HVAC Facts and Statistics You Need to Know in 2025 (w/ Infographic!) (https://workyard.com/construction-management/hvac-facts-statistics)

- Understanding the Risks: Why HVAC Contractors Need Specialized Insurance

- getjobber.com (https://getjobber.com/academy/hvac/hvac-industry-trends)

- 2025 HVAC Trends: Industry Outlook and Growth Opportunities (https://blog.sendwork.com/2024/10/2025-hvac-trends-industry-outlook-and-growth-opportunities)

- 11 (Mind-Blowing) HVAC Industry Statistics to Consider in 2025 (https://hvacwebmasters.com/hvac-industry-statistics)

- 44 HVAC Marketing Statistics You Should Know for 2025 (https://webfx.com/industries/home-repair/hvac/marketing-statistics)

- Navigating the Costs: How Much Does HVAC Insurance Really Cost?

- Types and Costs of HVAC Business Insurances (https://inquirly.com/price-of-hvac-business-insurance)

- kickstandinsurance.com (https://kickstandinsurance.com/blog/hvac-workers-comp-rates)

- How Much Does HVAC Insurance Cost? – Housecall Pro (https://housecallpro.com/resources/marketing/how-much-does-hvac-insurance-cost)

- The Importance of Regularly Reviewing Your HVAC Insurance Coverage

- HVAC Insurance for Businesses (https://thehartford.com/business-insurance/hvac-insurance)

- 44 HVAC Marketing Statistics You Should Know for 2025 (https://webfx.com/industries/home-repair/hvac/marketing-statistics)

- 75+ HVAC Facts and Statistics You Need to Know in 2025 (w/ Infographic!) (https://workyard.com/construction-management/hvac-facts-statistics)