Overview

Finding the right way to finance a new HVAC system can feel overwhelming, but there are supportive options available to ease this burden. Here are some viable choices:

- Home equity loans

- Personal loans

- Specialized financing from manufacturers

Home equity loans often stand out due to their lower interest rates and potential tax benefits. This article compassionately explores how each financing option works, emphasizing the advantages of home equity loans. It also shares real-world examples of homeowners who have successfully navigated these choices, demonstrating how they managed their HVAC system costs effectively. By understanding these options, you can feel more empowered and supported in making the best financial decision for your home.

Introduction

In the pursuit of optimal home comfort, the journey to finance a new HVAC system can evoke a blend of excitement and apprehension. Homeowners often find themselves navigating a sea of financing options, each tailored to diverse financial situations and aspirations. From personal loans and home equity lines of credit to specialized manufacturer financing, grasping the nuances of these choices is crucial for making informed and confident decisions.

As the importance of energy efficiency continues to rise, the possibility of tax credits and rebates introduces another layer of complexity to the financing landscape. This exploration seeks to illuminate the various pathways available, the influence of credit scores, and the long-term financial considerations that can empower homeowners to enhance their living environments, all while safeguarding their financial well-being.

Exploring Your HVAC Financing Options

When funding a new heating and cooling system, property owners often face the daunting task of navigating their financing options. It’s essential to find the best way to finance a new HVAC system, with choices that cater to various economic needs and circumstances. The primary options for financing include:

- Personal loans

- Home equity loans

- Credit cards

- Specialized financing provided by manufacturers or contractors in the heating and cooling industry

Personal loans are frequently favored for their quick access to funds, allowing property owners to address urgent heating and cooling needs without delay. In 2025, the average interest rates for personal loans hover around 10-12%, making them a feasible option for many. However, home equity loans typically offer lower interest rates, often ranging between 6-8%, as they are secured by the homeowner’s property. This collateral can render them an appealing choice for those with sufficient equity in their homes.

Credit cards can also serve as a means for financing heating and cooling systems, particularly for smaller expenses or when immediate payment is required. Yet, property owners should exercise caution due to high-interest rates, which can surpass 20% if balances are not settled promptly.

Financing through heating and cooling manufacturers or contractors is regarded as one of the most effective ways to finance a new HVAC system. This option often features promotional rates or deferred payment plans, streamlining the purchasing process and allowing homeowners to combine their equipment purchase with financial assistance.

In the New York-Newark-Jersey City region, where approximately 22,780 HVAC workers are employed, understanding these funding options becomes crucial for contractors aiming to serve their clients effectively. By utilizing Field Complete’s streamlined business management system, designed for ease of use, contractors can enhance their operations through simplified scheduling, estimating, and payment collection. This empowers them to focus on delivering exceptional service while managing their finances efficiently.

Consider trying it FREE to see how Field Complete can transform your business operations.

Real-world examples illustrate the effectiveness of these funding options. Many homeowners have successfully utilized personal loans, often deemed the best way to finance a new HVAC system, enabling them to enhance energy efficiency and comfort in their homes. Additionally, case studies reveal that employing specialized business management software, such as Field Complete, can improve project tracking and labor management, leading to more informed financial decisions.

The case study titled “Data-Driven Decision Making in HVAC” highlights how such software can assist businesses in the heating, ventilation, and air conditioning sector in navigating financial choices.

Expert opinions in 2025 stress the importance of evaluating the long-term implications of each funding option. Terence Chan, owner of Impetus Plumbing and Heating, shares his insight: “My advice is to lean into learning a new skill, do the hard work that’s required, and in the end, you become a master at the craft.” This perspective underscores the significance of skill development in making sound financial choices.

While personal loans may offer immediate relief, many homeowners discover that the best way to finance a new HVAC system is through home equity loans, which can provide more sustainable financial solutions for larger projects. Ultimately, understanding the nuances of these funding options, alongside utilizing tools like Field Complete, empowers property owners and contractors to identify the best way to finance a new HVAC system that aligns with their financial goals and heating and cooling needs.

Understanding Different Loan Types for HVAC Financing

When it comes to financing a new HVAC system, homeowners often find themselves facing a daunting array of loan options, each with distinct benefits that cater to individual financial situations. This can be overwhelming, but understanding these choices can empower you to make the best decision for your home.

- Personal Loans: These unsecured loans can be a lifeline for various needs, including HVAC purchases. With fixed interest rates and predictable repayment terms, they offer a sense of stability that many homeowners appreciate. However, it’s essential to consider how this option fits into your overall financial picture.

- Home Equity Loans: For those fortunate enough to have built significant equity in their homes, borrowing against that equity can provide access to funds at often lower interest rates compared to personal loans. This option is particularly appealing, as it allows homeowners to leverage their investment for necessary upgrades.

- Home Equity Lines of Credit (HELOCs): Similar to home equity loans, HELOCs offer a revolving line of credit based on home equity. This flexibility is invaluable, enabling homeowners to borrow as needed, making it a practical choice for ongoing heating and cooling costs or enhancements.

- Credit Cards: For smaller heating and cooling expenses, credit cards can offer a quick payment solution, especially if they come with low or 0% introductory APR deals. However, it’s crucial to manage this option carefully to avoid the pitfalls of high-interest debt.

- Manufacturer Financing: Many manufacturers in the heating and cooling sector provide direct financing options, often featuring promotional rates or deferred payment plans. This can simplify the purchasing process, making it easier to afford a new setup and ensuring you can keep your home comfortable.

In 2023, new energy efficiency standards for heating and cooling systems were implemented, requiring higher SEER and HSPF ratings. This shift not only enhances energy savings but also opens up opportunities for homeowners to qualify for tax credits up to $3,200 for making qualified energy-efficient improvements through 2032. This is a significant benefit that can ease the financial burden of upgrading your system.

Real-life instances, such as those from Buckeye Heating & Cooling, illustrate how heating and cooling payment options can accommodate different credit scenarios. They offer low-interest rates and flexible conditions, ensuring customers can obtain the necessary funds for heating, ventilation, and air conditioning services, facilitating easier upgrades and installations. As Jeff Aroff from Legacy Maintenance pointed out, “the streamlined access to job-related information” is essential for improving productivity, which also applies to the funding process for property owners.

Financial advisors often recommend considering home equity loans as the best way to finance a new HVAC system, given their lower interest rates and potential tax benefits. Statistics indicate that home equity loans are a popular choice for home improvement projects, with many homeowners leveraging their equity to fund significant upgrades.

As you explore your funding options, take the time to weigh the pros and cons of personal loans versus home equity loans. Personal loans provide rapid access to funds without requiring collateral, whereas home equity loans can offer larger sums at reduced rates, making them an attractive option for substantial investments in heating and cooling systems. Remember, the right choice can lead to a more comfortable home and peace of mind.

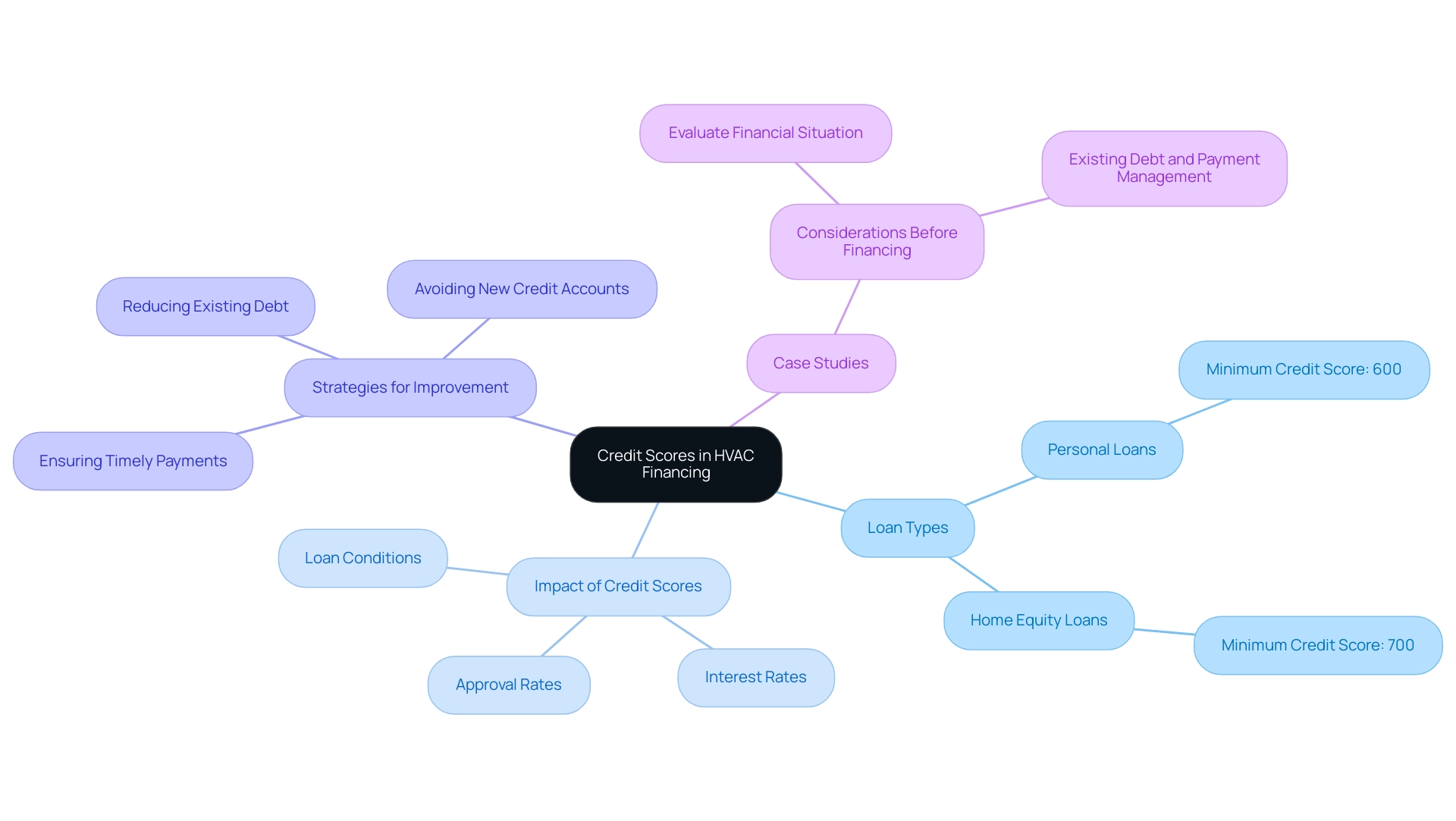

The Role of Credit Scores in HVAC Financing

Credit scores are a crucial factor in determining eligibility for funding heating and cooling systems, impacting both approval rates and loan conditions. Many lenders establish minimum credit score requirements that differ by loan type. For personal loans, a score of 600 or higher is typically necessary, while home equity loans often require a score of 700 or above.

A higher credit score not only increases the chances of approval but also leads to lower interest rates and more favorable loan conditions.

As we look to 2025, the average credit score requirement for heating and cooling loans reflects these trends, with numerous lenders tightening their criteria in response to shifting economic conditions. Homeowners are encouraged to proactively check their credit reports and correct any discrepancies before applying for loans. Strategies for improving credit scores include:

- Reducing existing debt

- Ensuring timely payments

- Avoiding the opening of new credit accounts prior to the loan application

Real-world examples highlight the significant impact of credit scores on HVAC funding. For instance, property owners with scores above 700 often secure loans with notably lower interest rates compared to those with scores in the 600 range. This difference can lead to considerable savings over the life of the loan, making it essential for consumers to understand their credit standing.

Financial specialists emphasize that maintaining a good credit score extends beyond merely obtaining funds; it also plays a vital role in managing overall financial health. By cultivating a strong credit profile, homeowners can access improved funding options and build or maintain their creditworthiness for future investments.

Furthermore, as discussed in the case study “Considerations Before Funding,” not everyone may benefit from funding. It is crucial for consumers to evaluate their financial situation, including existing debt and payment management, before proceeding. The best approach to financing a new HVAC system can be beneficial for reducing expenses, preserving emergency funds, and developing or sustaining credit, making it a more feasible investment.

In the realm of heating and cooling contractors, utilizing software such as Field Complete can ease the funding process. As Jeff Aroff noted, the platform provides “streamlined access to job-related information,” enhancing productivity and assisting contractors in managing customer interactions regarding funding options. Ultimately, understanding the connection between credit scores and heating and cooling financing empowers property owners to identify the most suitable ways to finance a new HVAC system, ensuring they select the best funding alternatives for their installations.

Advantage Heating and Air Conditioning, serving the Willamette Valley area, exemplifies how local contractors can apply these insights to better serve their clients.

Weighing the Pros and Cons of HVAC Financing

Financing an HVAC system can be a significant decision for homeowners, presenting both advantages and challenges that deserve careful consideration.

Pros:

- Affordability: Financing options offer a way for homeowners to spread the cost of a new HVAC system over time, making it more manageable. This can be particularly comforting, especially when the costs for certain HVAC units can range from $6,500 to $15,600 or more, making upfront payments a daunting task for many.

- Immediate Installation: Homeowners can replace outdated or inefficient units without the pressure of saving the entire amount upfront, ensuring that comfort and efficiency are restored without delay.

- Access to Higher-Quality Solutions: Financing empowers homeowners to invest in high-efficiency options that may come with a higher initial price but can lead to substantial energy savings in the long run. This is increasingly vital as the HVAC industry evolves towards advanced technologies that improve indoor air quality and energy efficiency. As Jeff Aroff from Legacy Maintenance highlights, funding can provide ‘streamlined access to job-related information,’ which is crucial for making informed decisions about upgrades.

Cons:

- Interest Costs: Homeowners should be aware that depending on their financing structure, interest charges may increase the total cost of the HVAC system. It’s important to evaluate the terms of funding to fully understand the long-term financial implications.

- Debt Accumulation: Taking on additional debt can create stress, especially if payments are not managed well. Homeowners are encouraged to assess their current financial situation to determine the best approach to financing a new HVAC system before committing to any options.

- Impact on Credit Score: Seeking a loan can result in a hard inquiry on credit reports, potentially leading to a temporary dip in credit scores. This is a significant consideration for homeowners who may have other important financial plans on the horizon.

Looking ahead to 2025, the benefits of financing heating and cooling systems are underscored by the potential for average cost reductions through the adoption of high-efficiency systems. As business owners and technicians in the heating and cooling sector stay abreast of industry trends, embracing intelligent climate control technology and utilizing related applications for enhanced management, financing becomes an essential resource for enabling these upgrades. Furthermore, Five Star Home Services offers support in navigating system upgrades, which can be especially beneficial for property owners exploring funding alternatives.

Real-world examples illustrate how financing has empowered property owners to transition to modern, eco-friendly solutions, aligning with the latest advancements in climate control technology, including the adoption of geothermal heat pumps. As the industry continues to evolve, staying informed about the best methods to finance a new HVAC system and understanding its implications can empower property owners to make decisions that enhance both their comfort and financial well-being.

Alternative Financing: Tax Credits and Rebates for HVAC Systems

Homeowners are presented with a unique opportunity to ease the financial burden of installing a new heating and cooling unit, which is often regarded as the most effective way to finance a new HVAC system, through various tax credits and rebates. The federal government currently offers a significant tax incentive for energy-efficient HVAC units, allowing residents to claim 30% of the installation costs on their tax returns from 2022 through 2032. This percentage is set to decrease to 26% in 2033 and 22% in 2034, making it essential for homeowners to act quickly to maximize their savings.

In addition to the federal incentives, many states and local utilities present appealing rebates for upgrading to high-efficiency systems. For instance, states like California and New York have launched programs that provide rebates ranging from $500 to $2,000 for qualifying heating and cooling system upgrades. Homeowners are encouraged to explore the specific incentives available in their area, as these can differ significantly and may include additional benefits for renewable energy investments.

Consulting with a heating and cooling contractor can further enhance the potential for savings. As Jeff Aroff from Legacy Maintenance points out, streamlined access to job-related information highlights the platform’s effectiveness in boosting productivity. Experts recommend that property owners discuss available incentives during the planning phase of their heating and cooling system installation.

This proactive approach ensures that all financial opportunities are thoroughly explored, maximizing potential savings. Understanding the landscape of tax credits and rebates is vital for property owners looking to find the best way to finance a new HVAC system with energy-efficient solutions.

Real-world examples illustrate the significant impact of these incentives. A recent case study highlighted how a property owner in Texas secured a $1,500 rebate from their local utility for upgrading to a high-efficiency heating and cooling system, along with the federal tax credit, resulting in total savings exceeding $3,000. Such financial incentives not only alleviate upfront costs but also contribute to long-term energy savings.

As the heating and cooling industry continues to evolve, staying informed about current tax credits and rebates is crucial. The case study titled “Preparing for 179D Tax Incentives and 45L Credits Benefits in 2025” emphasizes the importance of proactive preparation to maximize benefits from energy tax incentives. With anticipated changes in tax incentives through 2032, property owners should act now to fully leverage these opportunities.

Engaging with experienced heating and cooling specialists can provide valuable insights into the best way to finance a new HVAC system, ensuring that property owners make informed decisions that benefit both their finances and the environment. Additionally, platforms like Taxfyle inspire heating and cooling experts to increase their income by accepting tax-related jobs, further enhancing their service offerings and financial advantages for clients.

Long-Term Financial Considerations for HVAC Financing

When considering the best way to finance a new HVAC system, homeowners often face a daunting task. It’s essential to look beyond the initial purchase price to grasp the long-term financial implications that can significantly affect their well-being. Ongoing maintenance expenses play a crucial role in this evaluation, as they can vary widely based on the efficiency and type of technology. While high-efficiency technologies may incur higher upfront costs, they often lead to substantial energy savings over time, ultimately reducing monthly utility bills and providing peace of mind.

As we look toward 2025, it’s anticipated that average maintenance expenses for HVAC units will be approximately $150 to $300 each year, depending on the complexity and usage. Homeowners should also be aware of potential repair expenses, which can average between $200 and $500 per incident, alongside the anticipated lifespan of the equipment, typically ranging from 15 to 25 years for well-maintained units. Understanding these factors can evoke a sense of urgency in making informed decisions.

Incorporating insights from financial advisors reveals the importance of evaluating these long-term factors for making sound financial choices. For instance, investing in a high-efficiency heating and cooling unit can yield long-term financial benefits, with research indicating that homeowners can save up to 30% on energy expenses compared to traditional units. This knowledge can empower homeowners to take action toward a more sustainable future.

Real-life examples illustrate these points effectively. Homeowners who opted for energy-efficient solutions reported not only lower utility costs but also fewer maintenance issues, leading to a more predictable financial outlook. Furthermore, the availability of rebates and incentives for energy-efficient heating and cooling units can further alleviate initial expenses, making these choices more attainable and less stressful for families.

As noted, these rebates and incentives can significantly assist property owners in saving on both initial expenses and long-term energy costs for energy-efficient heating and cooling systems, offering a nurturing hand in their journey toward financial stability.

Additionally, trends in the heating and cooling sector, such as the shift to eco-friendly refrigerants and the increasing use of heat pumps, are shaping funding choices. By staying informed about these trends, contractors can better guide property owners toward the best options available, fostering a supportive environment.

By considering these long-term financial aspects, homeowners can identify the best way to finance a new HVAC system, aligning their funding choices with their broader financial health and energy efficiency objectives. This thoughtful approach ultimately leads to a more sustainable and cost-effective home environment. As Jeff Aroff from Legacy Maintenance highlights, “The streamlined access to job-related information emphasizes the platform’s effectiveness in enhancing productivity,” which is crucial for contractors in managing these financing decisions effectively. Furthermore, by incorporating educational content into marketing strategies, HVAC contractors can build customer trust and engagement regarding energy-efficient systems, ultimately driving business growth and fostering a sense of community.

Conclusion

Navigating the financing landscape for a new HVAC system can feel overwhelming, yet it offers a multitude of options designed to meet the diverse needs of homeowners. Personal loans, home equity loans, credit cards, and manufacturer financing each bring their own unique advantages and challenges. By understanding these options, homeowners can make informed decisions that align with their financial situations, ensuring they achieve optimal comfort without undue financial strain.

Credit scores are crucial in determining eligibility for various financing options. A higher credit score not only enhances the likelihood of approval but also secures more favorable interest rates, highlighting the importance of maintaining a healthy credit profile. As homeowners contemplate their financing paths, it is essential to consider both the immediate and long-term implications, including interest costs and the potential for debt accumulation.

In addition to traditional financing methods, tax credits and rebates for energy-efficient HVAC systems significantly improve affordability. Homeowners have the opportunity to leverage these incentives to reduce installation costs while reaping long-term savings through enhanced energy efficiency. Collaborating with knowledgeable HVAC contractors can help maximize these opportunities, ensuring that all potential financial benefits are thoroughly explored.

Ultimately, the choice to finance an HVAC system should stem from a comprehensive understanding of the available options, credit implications, and the potential for long-term savings. By thoughtfully weighing these factors, homeowners can enhance their living environments while safeguarding their financial well-being, making a sound investment in both comfort and sustainability.

Frequently Asked Questions

What are the main financing options for a new HVAC system?

The primary financing options for a new HVAC system include personal loans, home equity loans, credit cards, and specialized financing provided by manufacturers or contractors in the heating and cooling industry.

What are the benefits of using personal loans for HVAC financing?

Personal loans are favored for their quick access to funds, allowing homeowners to address urgent heating and cooling needs without delay. They typically have fixed interest rates and predictable repayment terms.

How do home equity loans compare to personal loans?

Home equity loans usually offer lower interest rates, ranging from 6-8%, as they are secured by the homeowner’s property. This makes them an appealing choice for those with sufficient equity in their homes, especially for larger projects.

Can credit cards be used to finance HVAC systems?

Yes, credit cards can be used for smaller heating and cooling expenses or when immediate payment is required. However, property owners should be cautious due to high-interest rates that can exceed 20% if balances are not paid off promptly.

What is specialized financing provided by manufacturers or contractors?

This type of financing often features promotional rates or deferred payment plans, making it an effective way to finance a new HVAC system while simplifying the purchasing process.

What are the advantages of using home equity lines of credit (HELOCs)?

HELOCs offer a revolving line of credit based on home equity, providing flexibility to borrow as needed for ongoing heating and cooling costs or enhancements.

What financial benefits are available for energy-efficient HVAC upgrades?

Homeowners may qualify for tax credits up to $3,200 for making qualified energy-efficient improvements through 2032, which can help alleviate the financial burden of upgrading their systems.

What should homeowners consider when choosing between personal loans and home equity loans?

Homeowners should weigh the pros and cons of each option. Personal loans provide rapid access to funds without collateral, while home equity loans can offer larger sums at reduced rates, making them more suitable for significant investments in heating and cooling systems.

How can contractors assist homeowners in navigating financing options?

Contractors can enhance their operations through streamlined business management systems, which help in scheduling, estimating, and payment collection, allowing them to focus on delivering exceptional service and managing finances efficiently.

List of Sources

- Exploring Your HVAC Financing Options

- 75+ HVAC Facts and Statistics You Need to Know in 2025 (w/ Infographic!) (https://workyard.com/construction-management/hvac-facts-statistics)

- 2025 HVAC Industry Trends and Statistics to Know for Success (https://getjobber.com/academy/hvac/hvac-industry-trends)

- prnewswire.com (https://prnewswire.com/news-releases/residential-hvac-market-to-grow-by-usd-39-62-billion-2025-2029-driven-by-hvac-demand-in-construction-and-ais-impact-on-market-trends—technavio-302342954.html)

- Understanding Different Loan Types for HVAC Financing

- 75+ HVAC Facts and Statistics You Need to Know in 2025 (w/ Infographic!) (https://workyard.com/construction-management/hvac-facts-statistics)

- HVAC industry statistics 2025 (https://consumeraffairs.com/homeowners/hvac-industry-statistics.html)

- How to Finance For HVAC Replacement: Good vs. Bad Credit (https://buckeyeheat.com/knowledge-center/learn-how-to-finance-a-new-hvac-system)

- The Role of Credit Scores in HVAC Financing

- HVAC Financing: Everything you need to know (https://advantageheatingllc.com/learning-center/hvac-financing-guide)

- MSc Finance (full-time) (https://lse.ac.uk/study-at-lse/graduate/msc-finance-full-time)

- Weighing the Pros and Cons of HVAC Financing

- How Much Will a New HVAC System Cost in 2025? | Five Star Home Services (https://myfivestarhomeservices.com/how-much-will-a-new-hvac-system-cost-in-2025)

- prnewswire.com (https://prnewswire.com/news-releases/residential-hvac-market-to-grow-by-usd-39-62-billion-2025-2029-driven-by-hvac-demand-in-construction-and-ais-impact-on-market-trends—technavio-302342954.html)

- 2025 HVAC Industry Trends and Statistics to Know for Success (https://getjobber.com/academy/hvac/hvac-industry-trends)

- Alternative Financing: Tax Credits and Rebates for HVAC Systems

- What HVAC Systems Qualify for Federal Tax Credits in 2025? | Taxfyle (https://taxfyle.com/blog/2023-federal-tax-credits-for-hvac)

- 179D Tax Incentives and 45L Credits for Energy Tax Benefits in 2025 (https://walkerreid.com/179d-tax-incentives-45l-credits-tax-benefits)

- Federal Tax Credits for Energy Efficiency (https://energystar.gov/about/federal-tax-credits)

- Long-Term Financial Considerations for HVAC Financing

- 2025 HVAC Industry Trends and Statistics to Know for Success (https://getjobber.com/academy/hvac/hvac-industry-trends)

- 75+ HVAC Facts and Statistics You Need to Know in 2025 (w/ Infographic!) (https://workyard.com/construction-management/hvac-facts-statistics)

- The Most Energy Efficient HVAC Systems (2025) (https://bkvenergy.com/blog/most-energy-efficient-hvac-systems)