Overview

The article titled “7 Key Advantages and Disadvantages of Net 30 Terms for Contractors” focuses on the implications of net 30 payment terms for contractors, highlighting both their benefits and challenges. Net 30 terms can enhance cash flow management and strengthen client relationships, but they also pose risks such as delayed payments and increased administrative burdens, which can significantly impact a contractor’s financial stability and operational efficiency.

Introduction

In the competitive landscape of contracting, understanding payment terms is crucial for financial stability and client relationships. Net 30 terms, which require clients to settle invoices within 30 days of receipt, offer a structured approach that can enhance cash flow management for contractors. However, while these terms provide predictability, they also come with risks, including delayed payments and increased administrative burdens.

This article delves into the intricacies of Net 30 terms, exploring their advantages and disadvantages, and offering insights into effective cash flow management strategies. Additionally, it highlights alternatives to Net 30 that contractors might consider, along with best practices for implementation and communication strategies to negotiate favorable terms.

By leveraging modern invoicing solutions, such as Field Complete, contractors can navigate the complexities of payment structures more effectively, ultimately fostering stronger client relationships and ensuring financial health.

Understanding Net 30 Terms: A Contractor’s Guide

Net 30 terms represent a structured agreement in which clients are required to settle invoices within 30 days of receipt. This financial arrangement is common in HVAC work and other industries, enabling professionals to complete their projects and issue invoices while providing clients a sufficient time frame to meet their fiscal responsibilities. A firm grasp of these terms is essential for builders, as it directly influences their cash flow management and the health of client relationships.

By utilizing Field Complete’s fast invoicing features, builders can streamline the invoicing process, create professional-looking invoices in the field or office, and ensure timely payments through prepayment options. Additionally, features such as bulk invoicing allow users to issue multiple invoices at the same time, significantly reducing administrative time and effort. Invoice scheduling enables builders to set specific dates for invoice delivery, ensuring that clients receive invoices promptly, which can enhance cash flow predictability.

Significantly, statistics indicate that general builders are raising their bids by 6% to 10% to offset the effects of delayed transactions, highlighting the essential importance of prompt dealings. Furthermore, recent analyses indicate fluctuations in construction input prices, with a decrease of 0.2% reported in December, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data. This highlights the necessity for builders to maintain cash flow stability amidst changing market conditions.

Modern payment solutions, including in-app payment collection and data synchronization, play a crucial role in enhancing relationships and trust within the construction industry by increasing transparency, which is vital for effective cash flow management. Additionally, the role of an accounts administrator is pivotal in reviewing accounts and ensuring accurate financial records, further assisting individuals in navigating cash flow challenges. Understanding and implementing net 30 terms, along with leveraging advanced invoicing solutions such as converting estimates into invoices, can provide HVAC professionals with a strategic advantage in managing their finances and enhancing client trust.

This conversion not only saves time but also ensures that estimates are accurately reflected in the invoices, minimizing discrepancies and fostering smoother transactions.

The Advantages of Net 30 Terms for Contractors

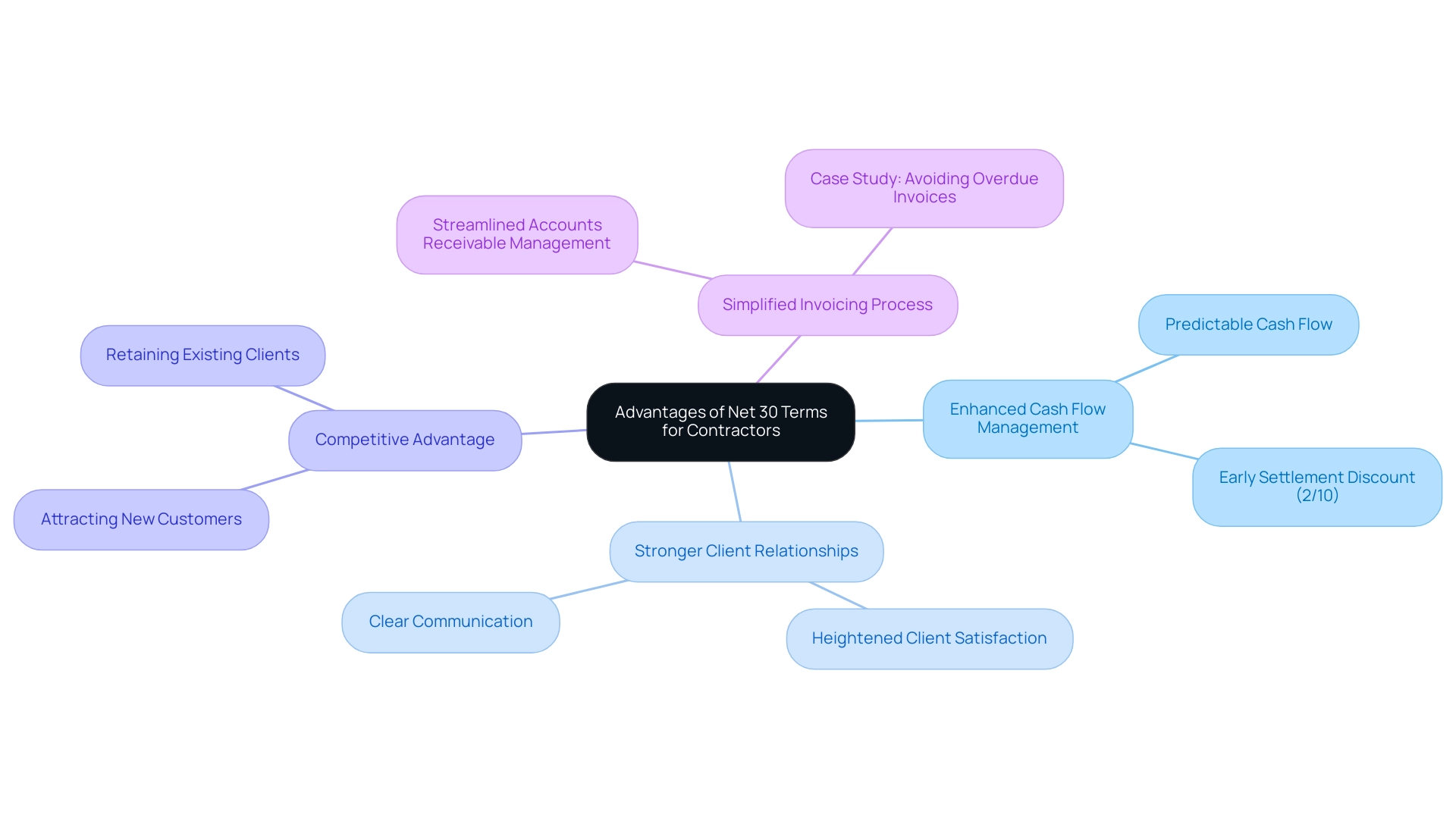

-

Enhanced Cash Flow Management: Embracing net 30 terms enables builders to achieve predictable cash flow, which aids in improved planning for expenses and investments. This organized method can significantly improve financial stability, enabling individuals to allocate resources more effectively and avoid cash flow crunches. Field Complete streamlines this procedure by facilitating easy scheduling, estimating, and invoice collection, which many builders have found decreases occurrences of overdue bills. The common early settlement discount of 2/10 is an example of net 30 terms that can financially benefit contractors by encouraging prompt remittances and improving cash flow.

-

Stronger Client Relationships: Flexible financial arrangements, such as net 30 terms, contribute to heightened client satisfaction and loyalty. Clients often appreciate the extended timeframe to settle invoices, which can cultivate a sense of mutual respect and partnership. As Tipalti observes,

Paying invoices early requires credit terms that define how and when an invoice will be paid early.

This highlights the importance of clear communication in strengthening contractor-client dynamics, allowing both parties to align their expectations. This tool improves this communication, ensuring all parties are informed and involved.

-

Competitive Advantage: In a saturated market, builders who offer net 30 terms can differentiate themselves by attracting clients seeking flexible financial solutions. This adaptability can not only attract new customers but also retain existing ones, enhancing overall market presence. Using Field Complete’s comprehensive features, HVAC professionals can streamline their services and present a more professional image, which clients increasingly prioritize.

-

Simplified Invoicing Process: Standardizing terms with net 30 terms helps to streamline the invoicing process, making it more manageable for contractors. This clarity assists in effective accounts receivable management, reducing uncertainty over financial expectations. The case study titled ‘Avoiding Overdue Invoices with net 30 terms’ illustrates this point, demonstrating how the implementation of net 30 terms can help businesses establish clear expectations for due dates, ultimately reducing the likelihood of overdue invoices. Furthermore, platforms such as Total offer tools for invoice monitoring and automated notifications, ensuring compliance and prompt settlements. Many users, including HVAC contractors, have praised Field Complete for its user-friendly interface, with one stating,

“Field Complete made invoicing so simple that even our newest team member could handle it without any training!

The Disadvantages of Net 30 Terms for Contractors

- Delayed Transactions: Contractors frequently face considerable cash flow difficulties when clients postpone settlements beyond the stipulated 30-day period. This disruption not only hampers their ability to settle obligations with suppliers and employees but also affects overall business operations. Recent reports indicate that 28% of builders have resorted to threatening legal action to ensure compensation, underscoring the severity of this issue. Malcolm Crumbley, an associate editor, remarked,

Last year was a challenging one for [builders regarding timely payments](https://pymnts.com/tracker_posts/from-the-ground-up-rebuilding-payments-in-the-construction-industry), reflecting the ongoing struggle within the industry. Additionally, a case study named ‘Impact of Regulatory Measures on Payment Delays’ emphasizes that despite current regulations aimed at safeguarding workers, these measures are frequently not followed, resulting in ongoing delays in disbursements. Field Complete can assist in alleviating these challenges by simplifying the collection processes, making it easier for builders to monitor overdue invoices and interact with clients. Its user-friendly interface ensures that even the most inexperienced users can navigate the system with ease, transforming how professionals manage their financial processes. - Increased Administrative Work: The burden of managing accounts receivable can escalate dramatically due to postponed transactions. Contractors may find themselves dedicating substantial administrative resources to follow up on overdue invoices, which diverts attention from core business activities. This added workload can strain small and medium-sized enterprises (SMEs), which already face challenges in managing cash flow effectively. By utilizing Field Complete, builders can automate invoicing and reminder notifications, significantly decreasing the administrative load and enabling them to concentrate on core business activities. The simplicity of the software empowers users to streamline their workflows, fundamentally changing the way they handle invoicing.

- Risk of Non-Payment: The inherent risk of clients failing to fulfill their financial obligations remains a pressing concern for builders. Such defaults can lead to significant financial losses, exacerbating the challenges of maintaining a steady cash flow. The implications of these risks are particularly pronounced for those relying on net 30 terms, as delays can quickly spiral into larger financial issues. In the context of the post-pandemic economy, adapting to these risks is essential for survival. With Field Complete’s advanced features for job management and customer communication, contractors can proactively address potential financial issues, enhancing their financial stability. The platform’s intuitive design makes it accessible, ensuring that all users can effectively utilize its capabilities.

- Impact on Credit Terms: Contractors may struggle to negotiate favorable credit conditions with suppliers if they heavily depend on net 30 terms. Irregular cash flow resulting from client delays in settling accounts can undermine their bargaining power, making it difficult to secure the necessary materials and services on credit. Moreover, ongoing payment issues can strain supplier relationships, further complicating the operational environment for workers. As the construction industry adapts to the challenges posed by the pandemic, addressing these credit term issues will be crucial for maintaining operational efficiency. By utilizing this platform, builders can enhance their cash flow management and fortify connections with suppliers, thus improving their negotiating stance. The transformative potential of Field Complete lies in its ability to simplify these processes, making it an essential tool for builders aiming to thrive.

Impact of Net 30 on Cash Flow Management

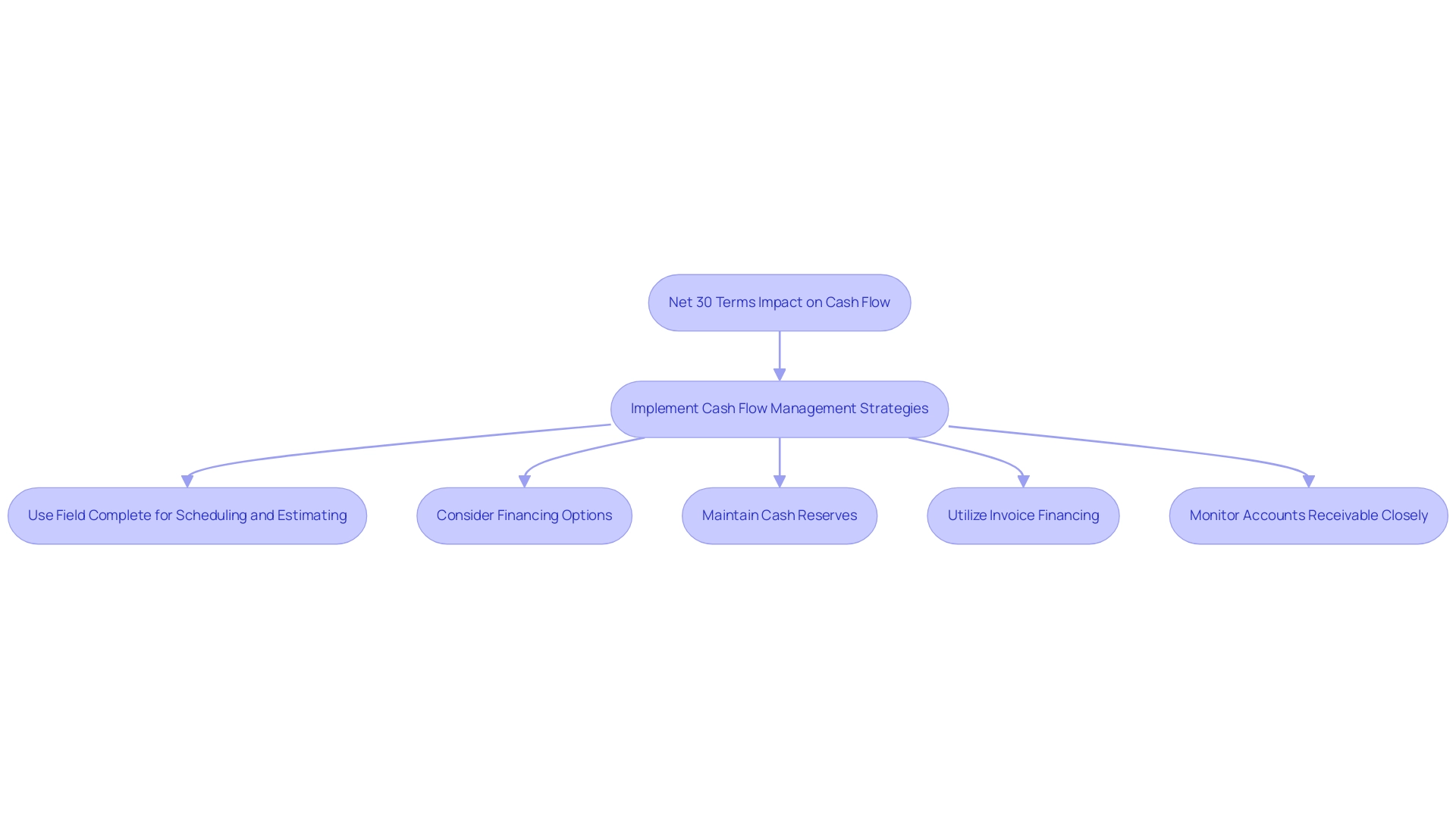

Net 30 terms can significantly influence a builder’s cash flow management. While net 30 terms provide a clear schedule for obtaining funds, they also expose builders to the risk of delays that can disrupt financial stability. To effectively navigate these challenges, HVAC professionals should consider implementing several cash flow management strategies.

Employing Field Complete can simplify this process by streamlining scheduling, estimating, and revenue collection, enabling builders to manage their projects more effectively. The system is designed to be simple and easy to use, even for the most inexperienced users, making it accessible for everyone involved. For instance, utilizing various financing options, such as lines of credit or project-specific loans, can support cash flow during critical project phases.

Keeping a cash reserve can offer a buffer during times of postponed transactions, ensuring that crucial operational expenses are met. Furthermore, invoice financing can act as a useful resource for builders who require prompt cash flow without awaiting client settlements. Monitoring accounts receivable closely is vital; by routinely assessing outstanding invoices through the extensive management software, contractors can pinpoint overdue amounts and take proactive measures to follow up with clients.

This approach not only helps in managing cash flow effectively but also reduces the risk of late or non-payment, ultimately enhancing overall financial health. As D. Neville Jones noted, effective management of financial processes is essential to ensure stability and growth. Moreover, technology can improve the management of transaction terms and cash flow by using online transaction systems within the platform to simplify the processing.

This can significantly reduce the risk of late or non-payment and improve overall cash flow. Try it FREE to see how Field Complete can transform your business operations.

Alternatives to Net 30: Finding the Right Payment Terms

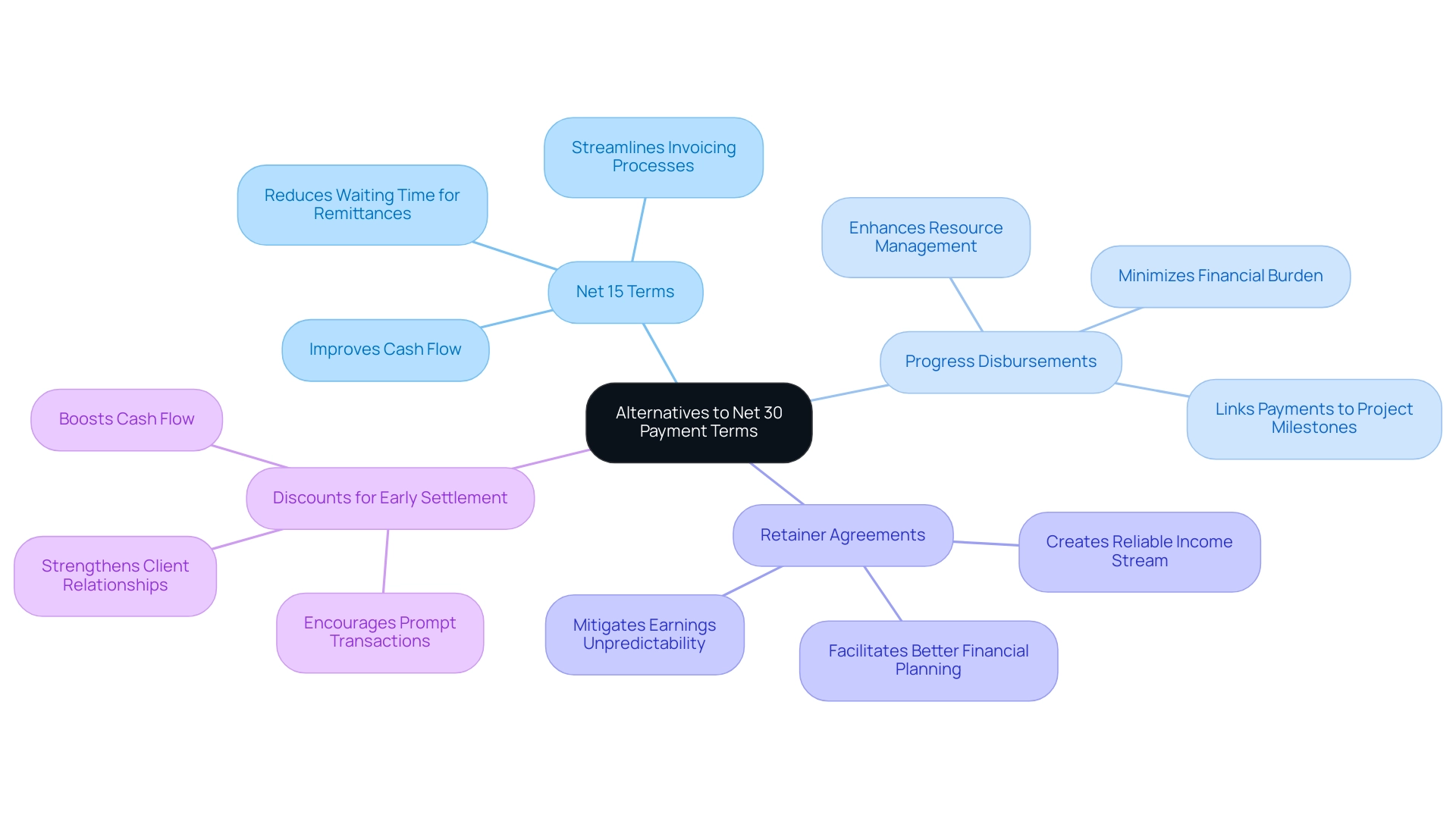

- Net 15 Terms: For builders aiming to improve their cash flow, Net 15 terms provide a practical solution by considerably reducing the waiting time for remittances. This approach not only alleviates financial strain but also fosters a healthier financial environment for ongoing projects. In fact, the preference score for rebates, which stands at 3, indicates a growing trend towards more favorable compensation arrangements. With the system finalized, managing these terms becomes even simpler through automated invoicing, allowing professionals to streamline their invoicing processes effortlessly. Try it FREE!

- Progress Disbursements: By implementing progress disbursements linked to project milestones, builders can obtain funds as work is accomplished. This strategy minimizes the financial burden and ensures a steady cash flow, which is crucial in an industry facing challenges such as materials pricing and staffing shortages. Field Complete supports this by offering tools for easy tracking of project milestones and financial schedules, making it user-friendly even for inexperienced users. Many builders have reported that this method enhances their ability to manage resources effectively. As noted by Atradius, businesses in Western Europe are increasingly offering credit to remain competitive, further emphasizing the importance of flexible payment strategies. Try it FREE!

- Retainer Agreements: Establishing retainer agreements with clients enables professionals to create a reliable income stream. This arrangement can mitigate the unpredictability of project-based earnings and enable better financial planning, proving essential amid the competitive contracting landscape. The case study titled “Optimism Amidst Industry Challenges” illustrates that despite ongoing economic challenges, many construction businesses remain optimistic about their financial prospects, rating their optimism as 8 or higher on a scale of 1 to 10. The system simplifies the management of these agreements, ensuring workers can concentrate on providing quality services. Try it FREE!

- Discounts for Early Settlement: Offering clients discounts for early invoice resolutions serves as an effective incentive for prompt transactions. This strategy not only boosts cash flow but also strengthens client relationships, creating a win-win situation for both parties. Additionally, as noted in the 2019 Payment Practices Barometer, businesses are increasingly adopting flexible credit terms to remain competitive, underscoring the value of such practices in today’s market. With Field Complete’s user-friendly system, contractors can easily establish and oversee discount programs to promote prompt transactions. Try it FREE!

Best Practices for Implementing Net 30 Terms

-

Clear Communication: Establishing clear financial terms from the outset is crucial for avoiding misunderstandings and ensuring timely transactions. Providing clients with a transparent overview of net 30 terms helps set expectations and fosters trust. John Meibers, Vice President & General Manager of Deltek ComputerEase, emphasizes that clear communication is vital for project-based businesses to maximize performance throughout the project lifecycle. Notably, statistics show that South Africa accounted for 63.9% of late payments last year, highlighting the detrimental effects of poor communication practices on payment timelines. Using the streamlined invoicing features, contractors can effortlessly convey these terms through professional-looking invoices generated in just one click. For detailed guidance on using these features, refer to the User Manuals available within the Field Complete platform.

-

Consistent Invoicing: Upholding a regular invoicing timetable is crucial for reminding clients of forthcoming dues and sustaining cash flow. By implementing a routine, builders can streamline their invoicing process and enhance predictability in payments. Field Complete supports this by allowing workers to create single and bulk invoices, as well as enabling invoice scheduling, ensuring that reminders are sent out on time. Additionally, the automated capabilities ensure that data is synchronized across platforms, reducing the risk of errors. Creating a service provider invoice email template, as noted in a case study, not only saves time but also ensures that messages remain consistent and professional. This consistency in communication significantly enhances the likelihood of prompt transactions, reinforcing the importance of this practice.

Follow-Up Procedures: Developing an effective follow-up procedure for overdue invoices is critical. This should include a system of reminders and escalation processes when necessary. Field Complete’s real-time communication features allow contractors to send reminders directly through the app, simplifying the management of overdue invoices. Statistics indicate that clear communication strategies can significantly enhance transaction timelines, as evidenced by the rise in late transactions in South Africa, which reached 63.9% due to poor communication practices.

Client Education: Informing clients about the advantages of prompt transactions fosters a cooperative relationship and improves mutual understanding. By emphasizing how regular contributions can lead to more effective project execution and success for both sides, builders can promote compliance with net 30 terms. Kelsey, a seasoned content marketer, notes that strong client relationships are built on transparency and consistent communication, which ultimately drives business success. With the invoicing capabilities of this service, professionals can effortlessly communicate the benefits of prompt payments through comprehensive invoices that detail project advancements and financial expectations. For additional details on utilizing these invoicing features, refer to the User Manuals supplied by the company.

Effective Communication Strategies for Negotiating Net 30 Terms

-

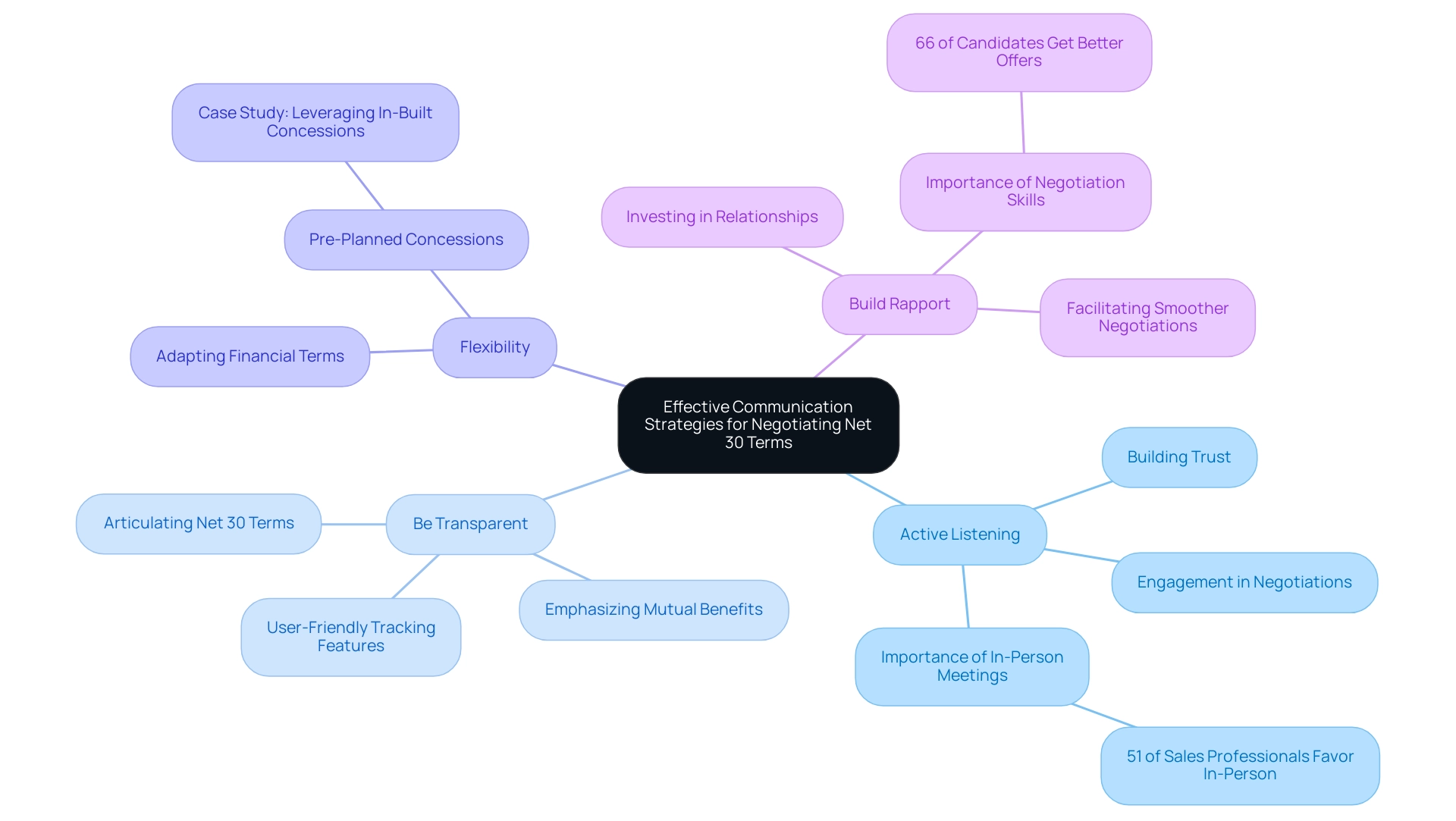

Active Listening: Engaging in active listening during contract negotiations is vital for comprehending client concerns and effectively addressing them. This practice not only ensures that the client’s needs are acknowledged but also fosters trust, which is essential in financial discussions. Research has shown that 51% of sales professionals regard in-person meetings as the most effective channel for establishing this level of communication, highlighting the importance of face-to-face interactions in building rapport. Utilizing a system created for simplicity and user-friendliness can enhance this process, enabling builders to concentrate more on active involvement instead of management duties. Try it FREE to see how it can transform your business management.

-

Be Transparent: Transparency plays a crucial role in negotiations, especially when proposing net 30 terms. Clearly articulating the reasons behind the net 30 terms and emphasizing the mutual benefits can help clients understand the value of this arrangement. When clients perceive the rationale behind proposals, they are more likely to feel positive about the terms being discussed. The user-friendly tracking features improve this clarity, simplifying the process for builders to offer clients with clear and concise financial information.

Flexibility: Demonstrating flexibility in negotiations can significantly enhance the likelihood of reaching an agreement. Being open to adapting financial terms to better fit the client’s preferences—while safeguarding your own interests—can lead to more favorable outcomes. The case study titled ‘Leveraging In-Built Concessions’ illustrates how negotiators can create initial offers with pre-planned concessions, fostering a positive perception and improving brand image. By utilizing Field Complete, builders can efficiently handle various financial scenarios, ensuring that they remain adaptable without compromising their operational efficiency.

Build Rapport: Establishing a strong rapport with clients is essential for successful negotiations. A positive relationship can make discussions about compensation terms more comfortable and productive. By investing time in relationship-building, builders can facilitate smoother negotiations and foster loyalty, which is especially important in an industry where maintaining a good client relationship can lead to repeat business and referrals. With the system managing scheduling and payment collection, contractors can devote more time to fostering these relationships. As noted by Pew, 66% of job candidates received better starting salary offers after negotiating, emphasizing the importance of negotiation skills in achieving favorable terms. Trusted by great teams, Field Complete is the ideal partner for your business needs.

Conclusion

Understanding and effectively managing Net 30 payment terms is essential for contractors navigating the complexities of cash flow and client relationships. These terms provide a structured timeline for payments, facilitating better financial planning and stability. By employing modern invoicing solutions like Field Complete, contractors can streamline their invoicing processes, reduce administrative burdens, and enhance communication with clients, ultimately fostering stronger relationships.

However, the challenges associated with Net 30 terms, such as delayed payments and increased administrative workload, cannot be overlooked. Contractors must remain vigilant and proactive in managing their accounts receivable to mitigate these risks. Implementing strategies such as:

- Clear communication

- Consistent invoicing

- Effective follow-up procedures

can significantly enhance the likelihood of timely payments, ensuring that financial health is maintained.

Exploring alternatives to Net 30, such as Net 15 terms or progress payments, can also provide valuable options for improving cash flow. By understanding the full spectrum of payment structures and leveraging technology to simplify invoicing and payment management, contractors can position themselves for success in a competitive market. Ultimately, adopting best practices and embracing innovative solutions will empower contractors to navigate payment complexities while building lasting, trust-based relationships with their clients.

Frequently Asked Questions

What are net 30 terms?

Net 30 terms are a financial agreement requiring clients to settle invoices within 30 days of receiving them. This arrangement is commonly used in industries such as HVAC, allowing professionals to complete projects and issue invoices while giving clients adequate time to pay.

Why are net 30 terms important for builders?

Understanding net 30 terms is crucial for builders as it directly impacts their cash flow management and client relationships. It helps in planning expenses and investments while ensuring financial stability.

How can builders streamline their invoicing process?

Builders can use Field Complete’s fast invoicing features to create professional invoices, utilize bulk invoicing for multiple invoices at once, and schedule invoice delivery to enhance cash flow predictability.

What are the benefits of using net 30 terms for cash flow management?

Net 30 terms enhance cash flow management by providing predictable cash flow, which allows builders to plan better for expenses and avoid cash flow issues. Early settlement discounts can also encourage prompt payments.

How do net 30 terms contribute to stronger client relationships?

Flexible arrangements like net 30 terms increase client satisfaction by offering them more time to settle invoices, fostering a sense of partnership and mutual respect between builders and clients.

Can offering net 30 terms provide a competitive advantage?

Yes, builders who offer net 30 terms can differentiate themselves in a competitive market by attracting clients looking for flexible payment options, which can enhance customer retention and overall market presence.

How do net 30 terms simplify the invoicing process?

Standardizing invoicing with net 30 terms clarifies financial expectations, making accounts receivable management easier for contractors and reducing the likelihood of overdue invoices.

What tools can help with invoice monitoring and compliance?

Platforms like Total offer tools for invoice monitoring and automated notifications to ensure compliance and prompt payments, helping contractors manage their invoicing effectively.

What role does an accounts administrator play in cash flow management?

An accounts administrator is essential for reviewing accounts and maintaining accurate financial records, which helps individuals navigate cash flow challenges effectively.